Get Ally Credit Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ally Credit Application online

Completing the Ally Credit Application online is a straightforward process designed to ensure you provide all necessary information accurately. This guide will walk you through each section of the application, helping to make your experience seamless and efficient.

Follow the steps to complete your application with ease.

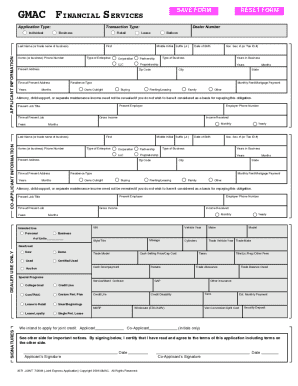

- Press the ‘Get Form’ button to access the Ally Credit Application and open it in your preferred editor.

- Begin by filling out the applicant information section. Provide your last name, middle initial, and suffix if applicable. Indicate whether you are applying as an individual or a business and enter your Social Security number or Tax ID number.

- Next, complete your present address details, including street address, city, state, zip code, and how long you have lived there. Ensure you include the type of residence — 'owning', 'buying', or 'renting/leasing'.

- Enter your date of birth and the type of business if applicable. Specify your present employer, job title, and how long you have been at your current job. Provide your employer's phone number and your gross income.

- If you have a co-applicant, complete the Co-Applicant Information section similarly, ensuring all details match where necessary. Include the co-applicant’s employment and residence information.

- Fill out the vehicle section by providing the vehicle identification number (VIN), intended use, make, model, mileage, and other relevant vehicle details.

- Review the dealer use only section, supplying any necessary details pertinent to your application, such as cash selling price, down payment, and any special programs you wish to apply for.

- Read and agree to the terms by signing the document. Both applicant and co-applicant must sign and date the application, indicating consent to the terms outlined.

- Finally, save your changes. You can choose to download, print, or share the completed application as needed.

Take action now and complete your Ally Credit Application online for a smoother financing experience.

Submitting a credit application for an Ally credit card is a straightforward process. You can easily complete the application online via the Ally website. Ensure you have all the necessary information ready, such as your social security number and income details, to make the submission seamless. After submitting your Ally credit application, you will receive feedback on your approval status.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.