Get Form 1091

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 730 online

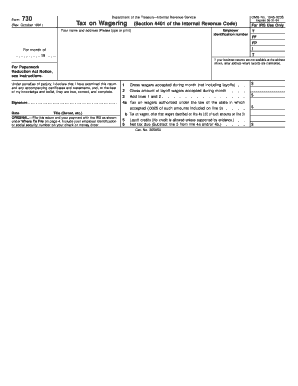

Filing the Form 730 is a crucial step for anyone involved in the business of accepting wagers or running a wagering pool or lottery. This guide will provide you with a clear, step-by-step approach to successfully complete the form online, ensuring compliance with tax laws.

Follow the steps to fill out Form 730 online with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name and address in the designated field as shown on the original documentation. Ensure that this information is accurate and up to date.

- Input your employer identification number in the specified section. This number is essential for tax reporting purposes.

- Indicate the month for which you are filing the form. This should match the reporting period for your wagering activities.

- If your business records are not maintained at the address provided, enter the address where they are kept.

- In the next section, fill in the gross wagers accepted during the month (not including layoffs). This total should encompass all wagering activities without additional charges that do not pertain to the wager.

- Enter the gross amount of layoff wagers accepted during the month in the subsequent field, ensuring you have proper documentation for these wagers.

- Add the totals from lines 1 and 2 to calculate the combined amount of wagers.

- For line 4a, calculate and enter the tax on wagers authorized under state law (0.0025 of the total amount from line 3).

- For line 4b, compute and input the tax on wagers not covered in line 4a (0.02 of the total amount from line 3).

- If applicable, enter any layoff credits you wish to claim, supported by evidence as specified.

- Finally, calculate the net tax due by subtracting any claimed layoff credits from the sums on lines 4a and 4b.

- Before submitting, sign and date the form in the designated area, indicating your title or role.

- Save changes to the form, then proceed to download, print, or share as necessary for submission.

Complete your tax filings efficiently by following these steps to fill out the Form 730 online.

To release your medical records to the VA, you'll need to complete the appropriate authorization form, allowing your healthcare provider to share your information. This authorization typically requires you to specify what records you authorize for release. For more accurate and comprehensive guidance on this process, consider using uslegalforms, which can help you navigate the necessary steps, including how to properly authorize the release of your records connected to Form 1091.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.