Get Fdic 5210 10 E Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FDIC 5210 10 E Form online

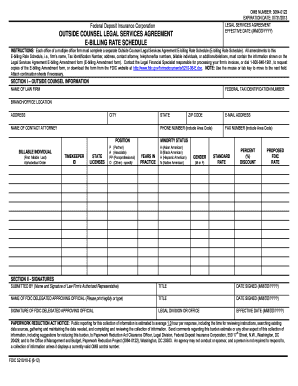

The FDIC 5210 10 E Form is a crucial document for outside counsel legal services agreement related to billing practices. This guide provides a clear, step-by-step approach to effectively complete the form online, ensuring that all necessary information is submitted accurately.

Follow the steps to successfully complete the FDIC 5210 10 E Form online.

- Press the ‘Get Form’ button to obtain the form and access it in your preferred online editor.

- In Section I, begin by entering the name of your law firm in the designated field.

- Next, input your firm's federal tax identification number accurately.

- Specify the branch or office location and provide the complete address, including city, state, and zip code.

- Identify the contact attorney by entering their name, phone number, and position within the firm.

- List the billable individuals in alphabetical order, along with their corresponding timekeeper ID and state licenses.

- Indicate the minority status for each billable individual and specify their gender using the provided options.

- Complete the fields for standard billing rates, including any percentage discounts applicable.

- In Section II, the authorized representative of the law firm must sign and date the form, providing their title.

- Lastly, ensure the FDIC delegated approving official reviews the form, provides their details, and records their signature and dates.

- Once all sections are thoroughly completed, save the changes and choose to download, print, or share the form as needed.

Start completing your FDIC 5210 10 E Form online today to ensure timely and accurate processing.

An FDIC certificate, often referred to as an FDIC certificate of insurance, serves as proof that a bank is insured by the FDIC. It indicates that deposits are protected up to the allowed limits, thus assuring customers of their financial safety. You can usually find this certificate displayed in the bank's branch or on their website, reflecting their commitment to safeguarding your funds.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.