Loading

Get Fatca Hsbc 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fatca HSBC online

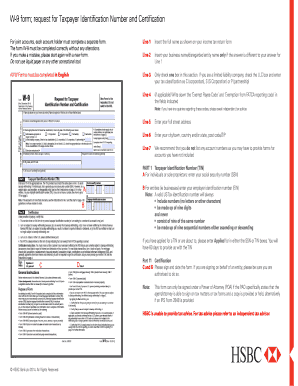

Filling out the Fatca HSBC form accurately is crucial for compliance with tax regulations. This guide provides clear, step-by-step instructions to help you navigate the online form.

Follow the steps to successfully complete the Fatca HSBC form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In Line 1, enter your full name exactly as it appears on your income tax return form.

- For Line 2, provide your business name or disregarded entity name, only if it differs from the name entered in Line 1.

- In Line 3, select only one box. If you are a limited liability company, check the LLC box and indicate your tax classification (C, S, or P).

- If applicable, write your ‘Exempt Payee Code’ and ‘Exemption from FATCA reporting code’ in Line 4. Consult an independent tax advisor if you have any questions about these codes.

- In Line 5, enter your complete street address.

- For Line 6, provide your city or town, country and/or state, and ZIP code.

- In Line 7, it is advised not to list any account numbers as you may need to provide information for accounts not included.

- For Part 1, Taxpayer Identification Number (TIN), enter your Social Security Number (SSN) if you are an individual or sole proprietor. If you are an entity, enter your Employer Identification Number (EIN). If you have applied for a TIN, write 'Applied for' in the relevant boxes.

- Complete Part II by signing and dating the form in sections C and D. Ensure you are authorized to sign on behalf of an entity if applicable.

- Once all fields are filled out correctly, you can save changes, download, print, or share the completed form.

Start completing your documents online today!

FATCA status refers to the classification given to individuals or entities based on their registration and compliance under the FATCA regulations. This status determines the reporting requirements for financial institutions. Institutions like Fatca Hsbc assist clients in understanding their FATCA status and implications. Being aware of your status aids in aligning your financial practices with regulatory expectations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.