Get Form Pa 3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form PA 3 online

Filling out the Form PA 3 online is a straightforward process that ensures you meet your tax obligations efficiently. This guide provides detailed, step-by-step instructions to assist you in completing the form accurately and effectively.

Follow the steps to complete the Form PA 3 online.

- Click the ‘Get Form’ button to access the form and open it in the online editor.

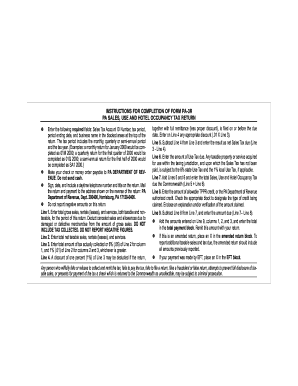

- Enter the required fields at the top of the return: provide your Sales Tax Account ID Number, tax period, period ending date, and business name. Ensure you correctly indicate whether the tax period is monthly, quarterly, or semi-annual.

- On Line 1, input the total gross sales, rentals, and services, including both taxable and nontaxable amounts for the reporting period. Remember to exclude tax collected and do not report negative figures.

- For Line 2, enter the total net taxable sales, rentals, and services.

- In Line 3, record the total amount of tax actually collected. This amount should be the greater of either 6% of Line 2 for column 1 or 1% of Line 2 for columns 2 and 3.

- On Line 4, if applicable, enter a 1% discount of the amount reported on Line 3. This discount is only valid if your return with full payment is filed on or before the due date.

- Calculate the net Sales Tax due for Line 5 by subtracting Line 4 from Line 3.

- For Line 6, enter the amount of Use Tax due on any taxable property or service acquired for use within the jurisdiction, where the Sales Tax has not yet been paid.

- Add the amounts from Line 5 and Line 6 to determine the total Sales, Use, and Hotel Occupancy Tax due; record this total on Line 7.

- On Line 8, indicate any allowable TPPR credit by entering the amount and checking the appropriate block to identify the type of credit being claimed. Remember to include any required explanations or verification.

- Subtract Line 8 from Line 7 to find the total amount due, which should be entered on Line 9.

- Add any amounts entered on Line 9 across columns 1, 2, and 3, and enter this total in the total payment block.

- If this is an amended return, mark the amended return block with an 'X'. Ensure all previous amounts are included for accuracy.

- If your payment was completed using EFT, mark the EFT block with an 'X'.

- Once all sections are filled out accurately, save your changes, download, print, or share the form as needed before submission.

Complete your Form PA 3 online today to ensure compliance with your tax obligations.

To ask your doctor for a handicap placard, explain your mobility challenges and why you need special parking access. Provide them with details about the Form PA 3, which they may need to complete as part of your application. It's helpful to discuss your condition openly, enabling your doctor to understand your situation better. Once they agree, they can fill out the necessary information, which will support your application process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.