Loading

Get Sars Da185

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sars Da185 online

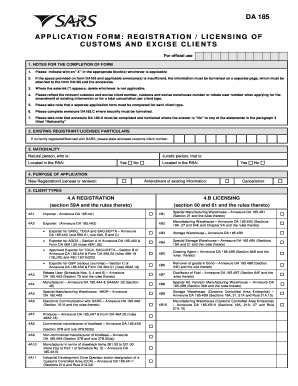

The Sars Da185 form is essential for the registration and licensing of customs and excise clients. This comprehensive guide provides detailed instructions on how to fill out the form online, ensuring users can navigate each section with confidence.

Follow the steps to successfully complete the Sars Da185 form online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- In the notes for the completion of the form, indicate with an ‘X’ in the blocks that apply to you.

- If additional space is needed for your answers, provide the information on a separate page and attach it to your form.

- Where an asterisk (*) appears, delete the option that does not apply to your situation.

- Include your relevant customs and excise client number or other important numbers if you are amending existing information.

- Remember that a separate application form is required for each client type.

- If applicable, complete annexure DA185.C to provide security details.

- If you answer “No” to any nationality questions, complete and attach annexure DA185.D.

- Fill in your existing registrant/licensee particulars, including any allocated customs client number.

- Indicate your nationality, confirming if you are a natural or juristic person, and if located in South Africa.

- Specify the purpose of your application (new registration, amendment, cancellation) and identify your client type accordingly.

- Complete business and personal details, including your business address and contact information.

- Fill in your South African bank account details or mark if you do not have a local account.

- If applicable, provide any SARS revenue identification numbers you possess.

- Describe the nature of your business by selecting the appropriate category.

- Fill in details for sole proprietors, individuals, directors, or partners as required.

- Complete information for the public officer or representative handling the application.

- Answer the questions regarding contraventions and include further details as necessary.

- Attach all supporting documents that are less than three months old as specified in the instructions.

- Finalize your application by declaring the accuracy of the information, signing, and dating the document.

Complete your Sars Da185 form online today for a smoother registration and licensing experience.

Claiming VAT from SARS involves submitting a VAT refund application, supported by invoices and relevant documentation. Generally, you should expect processing times of up to 21 business days for refunds to be approved. To enhance your understanding and ensure accuracy in submissions, platforms like USLegalForms can provide guidance when interacting with SARS and managing claims related to Sars Da185.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.