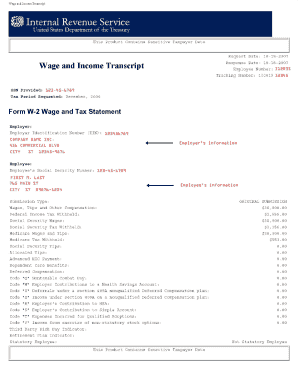

Get Irs Tax Transcript Sample. Sample Tax Return Verification From The Irs 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Tax Transcript Sample: Sample Tax Return Verification From The IRS online

This guide provides clear and practical instructions for completing the IRS Tax Transcript Sample, specifically the Sample Tax Return Verification from the IRS. Whether you are new to tax forms or experienced, this comprehensive overview will help you navigate each section with confidence.

Follow the steps to effectively complete your IRS Tax Transcript Sample.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering your personal details in the designated fields. This includes your name, address, and Social Security number, ensuring that the information is accurate and up-to-date.

- Next, specify the type of transcript you need. The IRS provides various options, such as tax return transcripts or account transcripts, based on your specific requirements.

- Indicate the tax year for which you are requesting the transcript. Use the dropdown menu, if available, to select the correct year.

- Provide any additional information requested, such as your filing status or information about your spouse, if applicable.

- Review the completed sections for accuracy. Double-check all entered information to avoid processing delays.

- Finally, save your changes, and download, print, or share the form as needed for your records or submission.

Take the next step in managing your financial documentation by completing the IRS Tax Transcript Sample online today.

The fastest method to get a copy of your tax return is to use the IRS online portal, where you can generate a transcript of your filing. If you need a full copy of your return, you can request it via Form 4506, but be prepared for a longer wait. Using US Legal Forms can streamline the request process since they provide easy-to-understand templates. This way, you can ensure that your IRS Tax Transcript Sample is accessible whenever needed.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.