Loading

Get A 3730 Uez Form 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the A 3730 Uez Form online

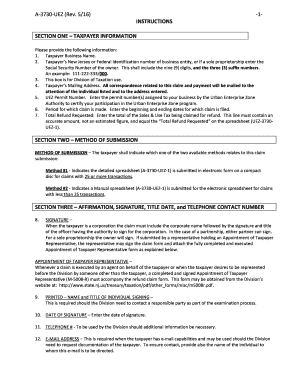

The A 3730 Uez Form is essential for claiming refunds on sales and use tax for businesses in New Jersey participating in the Urban Enterprise Zone program. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out the A 3730 Uez Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section One, provide your taxpayer business name and identification number, which may be the New Jersey or Federal Identification number or Social Security Number for sole proprietorships. Ensure this information is accurate.

- Enter your mailing address where all correspondence related to your claim and payment will be sent.

- Input your UEZ permit number assigned by the Urban Enterprise Zone Authority to verify your participation.

- Specify the period for which the claim is made by indicating the beginning and ending dates.

- Calculate and enter the total refund requested, ensuring it matches the same amount on your supporting spreadsheet.

- In Section Two, choose the method of submission: either a detailed electronic spreadsheet on CD for 25 or more transactions, or a manual spreadsheet if there are fewer than 25 transactions.

- In Section Three, provide the necessary signature, printed name, title, date, telephone number, and email address for the individual submitting the form. If applicable, ensure that an Appointment of Taxpayer Representative form is attached.

- Review all entries for completeness. Save changes, download the completed form, and print for your records.

- Share or submit the form and supporting spreadsheet to the NJ Division of Taxation, ensuring that all required documentation is included.

Complete your A 3730 Uez Form online today to expedite your refund process.

Filing Form No 10IEA requires compiling your financial records to determine the tax due. Access the form through the official tax website or platforms like USLegalForms for assistance with the A 3730 Uez Form, making the submission process smoother and less daunting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.