Loading

Get Iht35

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht35 online

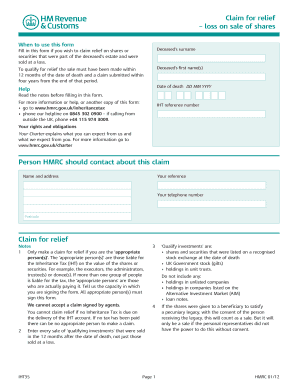

The Iht35 form is used to claim relief on shares or securities sold at a loss that were part of a deceased’s estate. This guide provides clear, step-by-step instructions to help you complete this form accurately and efficiently.

Follow the steps to successfully complete the Iht35 form online.

- Press the ‘Get Form’ button to access the Iht35 form and open it in your preferred online editor.

- Enter the deceased’s surname and first name(s) in the designated fields.

- Fill in the date of death in the format DD MM YYYY. This date is pivotal for your claim.

- Provide the IHT reference number, which is necessary for processing your application.

- Identify the person HMRC should contact regarding this claim by entering their name, address, and telephone number.

- List every qualifying investment sold within the 12 months following the date of death in the appropriate section, noting both the sale and purchase dates.

- Ensure to include the price for both the sales and purchases along with total values in specified columns.

- Calculate the net loss by subtracting the total purchases from the total sales.

- If applicable, address any purchases of qualifying investments made between the date of death and the two months after your latest sale.

- Complete the additional questions regarding capital payments and changes in holdings as prompted.

- In the repayment authority section, state to whom the repayment cheque should be issued.

- Finally, declare that the information provided is true and sign the form in the appropriate sections.

- Once completed, save your changes, and choose to download, print, or share the completed form as needed.

Start completing your Iht35 form online today.

Filing a 10IEA involves preparing the necessary documentation to submit to the appropriate regulatory body. Make sure all required forms are completed accurately, paying attention to the Iht35 specifics. Use reliable online forms software like US Legal Forms to streamline the process and ensure compliance with filing requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.