Loading

Get Write Off Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Write Off Form online

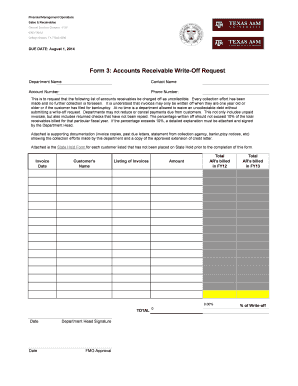

This guide provides comprehensive instructions on completing the Write Off Form online. Follow the steps outlined below to ensure that your submission is accurate and meets all necessary requirements.

Follow the steps to complete the Write Off Form online.

- Click ‘Get Form’ button to obtain the form and access it in the editor.

- Enter your department name in the designated field to identify the request origin.

- Provide the contact name of the person completing the form to facilitate communication.

- Fill in the account number associated with the receivable that is being requested for write-off.

- Input the phone number of the contact person to ensure they can be reached if any additional information is required.

- List the accounts receivable that are being requested for write-off. Ensure that all collection efforts have been noted as this is a mandatory requirement.

- Attach supporting documentation, such as invoice copies or collection agency statements, to demonstrate collection efforts made.

- Confirm that the total amount of accounts receivables does not exceed 10% of the total receivables billed for that fiscal year.

- If applicable, include a detailed explanation signed by the Department Head if the write-off exceeds the allowed percentage.

- Ensure the State Hold Form is attached for each customer listed who has not been previously placed on State Hold.

- Obtain the necessary signatures from the Department Head and the FMO approval before finalizing the form.

- Once completed, save changes, download, print, or share the form as needed.

Complete your Write Off Form online today to streamline your financial management process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The best tax write-off often depends on your personal or business circumstances. Commonly beneficial write-offs include home office deductions, business expenses, and educational expenses. Identifying the most advantageous write-offs can save you a significant amount on taxes. Utilizing a Write Off Form can help you discover and manage these opportunities effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.