Loading

Get Schedule M 1 Excel Template

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Schedule M 1 Excel Template online

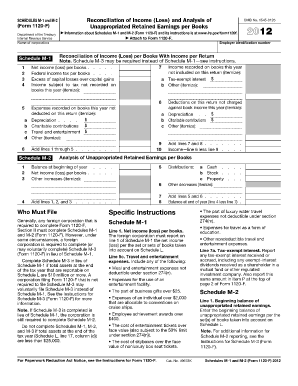

The Schedule M 1 Excel Template is an essential document for foreign corporations to reconcile their income and analyze retained earnings. This guide will help you navigate the process of filling out the form effectively and accurately online.

Follow the steps to complete the Schedule M 1 Excel Template online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the corporation in the designated field. Ensure that the name matches the corporation’s official documents for consistency.

- In the employer identification number section, input the unique identification number assigned to the corporation. This number is crucial for proper identification.

- For line 1, report the income recorded on the books that is not included on this return. Specify any tax-exempt interest and other income sources in the itemized sections.

- Move to lines 2 through 5 to list down expenses recorded on the books not deducted on this return. Itemize each expense, including depreciation and charitable contributions.

- After listing all relevant income and deductions, calculate the net income or loss per books on line 6 by subtracting the total deductions from total income.

- Proceed to Schedule M-2 to analyze retained earnings. Input the beginning balance and subsequent net income or loss, ensuring all components are correctly itemized.

- Review all entries for accuracy and completeness, then save any changes made to the form.

- Finally, choose to download, print, or share the completed Schedule M 1 Excel Template as needed.

Complete your documentation online and ensure accurate filing.

To get the 1st of every month in Excel, use the EDATE function, which allows you to calculate future dates based on the start date you provide. Starting from the first date, you can simply add 1 month to each following cell. For a more visual representation, consider using a Schedule M 1 Excel Template to help organize these dates efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.