Loading

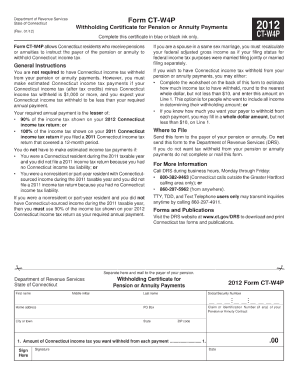

Get Ctw4p

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ctw4p online

Filling out the Ctw4p form online can be a straightforward process with the right guidance. This guide will provide you with clear instructions to ensure you complete each section accurately and efficiently.

Follow the steps to fill out the Ctw4p form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields. This typically includes your name, address, and contact details. Ensure that all information is accurate and up-to-date.

- Next, provide any necessary identification numbers as specified in the form. This may include social security numbers or employee identification numbers, depending on your situation.

- Review each section carefully for any additional information required. Some forms may ask for specific details about employment status or benefits. Take your time to read these fields.

- Once all mandatory fields are filled, review your entries for completeness and accuracy. Check for any spelling mistakes or missing information.

- After verifying all details, save your changes. This will often be an option within the editor, allowing you to keep a copy of your work.

- Finally, choose to download, print, or share the completed form as needed, ensuring you have a backup for your records.

Begin the process of completing your Ctw4p form online today!

To file form 10IEA, you need to gather the necessary information related to your income and expenses. The form is generally submitted through the appropriate state department channels, either electronically or by mail. If you're uncertain about the filing process, US Legal Forms offers templates and resources that can help make your filing experience smoother.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.