Loading

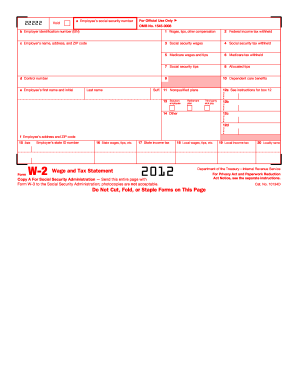

Get W2 Form Pdffiller 2020-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W2 Form Pdffiller online

Filling out the W2 Form online can streamline your tax reporting and ensure accuracy. This guide provides clear, step-by-step instructions for completing the W2 Form Pdffiller, making the process user-friendly for everyone.

Follow the steps to accurately complete the W2 Form online.

- Click the ‘Get Form’ button to acquire the W2 Form and open it in an online editor.

- Enter the employee’s social security number in box 'a'. Ensure this number is correct to avoid any discrepancies with the IRS.

- Input the employer identification number (EIN) in box 'b'. This number identifies the employer for tax purposes.

- Fill in the employer's name, address, and ZIP code in box 'c' to provide the necessary identification for the employer.

- Complete box '1' with total wages, tips, and other compensation received by the employee during the tax year.

- Record the amount of federal income tax withheld in box '2'. This should reflect the total withheld from the employee's wages.

- Complete box '3' with social security wages. Only include amounts that are subject to social security tax.

- Fill out box '4' with the amount of social security tax withheld from the employee's wages.

- Enter the total Medicare wages and tips in box '5', ensuring to include all applicable earnings.

- Record the Medicare tax withheld in box '6' to reflect what was deducted from the employee's pay for Medicare taxes.

- If applicable, fill in any allocated tips in box '8'. This is important for reporting additional income.

- Complete boxes '10' and '11' if the employee received dependent care benefits or if there are nonqualified plans.

- Input the employee's address in box 'f', including ZIP code, for accurate correspondence.

- Fill in the state information, including state wages in box '16' and state income tax in box '17', as applicable.

- Finally, ensure all fields are correct, save your changes, and choose to download, print, or share the completed form as necessary.

Start filling out your W2 Form online today for a seamless tax filing experience!

The blank local wages and tips section on your W2 Form Pdffiller shows the total amount you earned in a specific locality during the tax year. It is crucial for calculating any local income taxes owed. If you haven't earned income subject to local taxation, this section may remain blank. Always double-check this information to ensure accurate reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.