Loading

Get Vat 427

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat 427 online

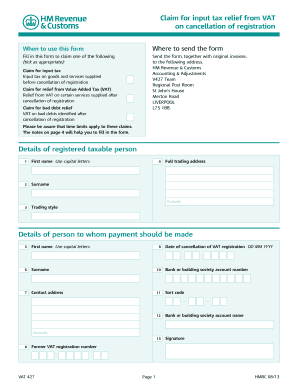

The Vat 427 form is used to claim input tax relief from VAT upon cancellation of registration. This guide provides structured and user-friendly instructions on how to complete the form online, ensuring that all necessary details are captured correctly.

Follow the steps to accurately complete the Vat 427 form online.

- Press the ‘Get Form’ button to obtain the Vat 427 form and access it in your online environment.

- Begin filling in the details of the registered taxable person. Provide your first name, surname, trading style, and full trading address along with your postcode.

- For the person to whom payment should be made, enter their first name, surname, contact address, email address, bank or building society account number, sort code, account name, and the former VAT registration number.

- Indicate the date of cancellation of VAT registration in the specified format (DD MM YYYY).

- In the section for details of goods and services for which you wish to claim, list the description of goods and services, the amount of VAT claimed, the time of supply, the name and address of the supplier, and the date of the invoice.

- Complete the declaration section by entering the full name of the signatory and signing to confirm the truthfulness of the information provided.

- Before submission, check all entries for accuracy, then save your changes, and prepare to download, print, or share the completed form.

Complete your Vat 427 claim online for efficient processing.

To write your VAT number, start with the specified format for your country, typically including the country code followed by a unique series of digits. For example, in the United States, you might incorporate your business registration details. Make sure you use the correct format to avoid issues with your VAT 427 filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.