Loading

Get Asmt 14 Pdf Download 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Asmt 14 Pdf Download online

Filling out the Asmt 14 Pdf Download form correctly is essential for ensuring compliance with tax regulations. This guide provides a step-by-step approach to help you complete the form accurately and efficiently.

Follow the steps to complete the Asmt 14 Pdf Download form online.

- Click the ‘Get Form’ button to access the Asmt 14 Pdf Download form and open it in your preferred PDF editor.

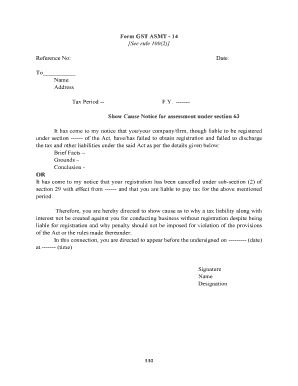

- Begin by entering the reference number and date in the respective fields at the top of the form. Ensure that these details are accurate as they are crucial for processing your submission.

- In the section labelled 'To', fill in the name and address of the individual or organization that the notice is directed to. This helps to identify the subject of the assessment.

- Indicate the relevant tax period and financial year in the specified fields. This information is necessary to establish the time frame for which the tax liabilities are being assessed.

- Provide a brief description of the facts surrounding the case in the 'Brief Facts' section. Be concise yet thorough to ensure that the reader fully understands the context.

- Outline the grounds for the assessment in the 'Grounds' section. This should detail the reasons you believe the assessment is necessary, referencing any applicable laws or regulations.

- In the 'Conclusion' section, summarize your position and any relevant points that support your case for the assessment.

- Include the date and time you are directed to appear before the undersigned. This section should highlight the importance of your attendance in response to the notice.

- Lastly, review your entries for accuracy. Once confirmed, save your changes, and choose to download, print, or share the completed form as needed.

Start completing your tax documents online today to ensure compliance.

Issuing ASMT-10 is mandatory when you receive a scrutiny notice under GST. This form allows you to respond to queries raised by tax authorities related to discrepancies in your tax filings. It is essential to understand this obligation, and referring to the ASMT 14 PDF can provide clarity on the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.