Get Et 141 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ET-141 online

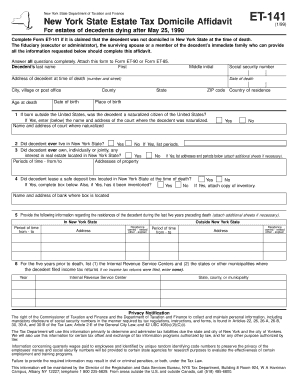

The ET-141 form is a crucial document for determining the domicile of a decedent for estate tax purposes in New York State. This guide provides clear instructions on how to complete the form online, ensuring that users can efficiently and accurately submit their information.

Follow the steps to fill out the ET-141 online:

- Click the ‘Get Form’ button to obtain the ET-141 form and open it in your online editor.

- Begin by filling in the decedent's last name, first name, and middle initial.

- Provide the decedent's social security number and address at the time of death, including city, state, ZIP code, and country of residence.

- Record the decedent's age, date of death, date of birth, and place of birth.

- Indicate whether the decedent was a naturalized citizen if they were born outside the United States, and provide the name and address of the court where they were naturalized, if applicable.

- Answer whether the decedent ever lived in New York State and list relevant periods if applicable.

- Indicate whether the decedent owned any real estate in New York State and provide details including addresses and periods if applicable.

- State whether the decedent had a safe deposit box in New York State at the time of death and supply the name and address of the bank if applicable.

- Detail the residences of the decedent for the five years prior to death, including addresses inside and outside New York State.

- List any income tax returns filed by the decedent for the last five years and provide information on the IRS centers and states involved.

- Describe the states where the decedent was registered to vote during the last five years prior to death.

- Provide information regarding any employment or business activities the decedent was engaged in during the five years preceding death.

- Note any legal proceedings in which the decedent was involved in New York State over the last five years.

- Mention any licenses the decedent held and provide the license number and type.

- Indicate any trust indentures, deeds, or other residency documents executed by the decedent in the last five years.

- Disclose any church, club, or organization memberships of the decedent and provide details.

- Submit any additional information that supports the claim that the decedent was not domiciled in New York State.

- Complete the applicant’s information, ensuring to include the relationship to the decedent and a statement to induce the Commissioner of the Department of Taxation and Finance.

- Sign the form and have it sworn before a notary public or an authorized New York State representative.

Complete your ET-141 form online today for accurate and efficient processing.

The limit for inheriting without incurring estate taxes can vary based on state laws and the overall value of the estate. Generally, under current IRS guidelines, estates valued below a certain threshold may not owe federal estate taxes. However, local laws can differ, so it's important to understand specific regulations in your state. Consider consulting US Legal Forms for comprehensive information on inheritance taxes and estate planning tools.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.