Loading

Get 93 0386945 F

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 93 0386945 F online

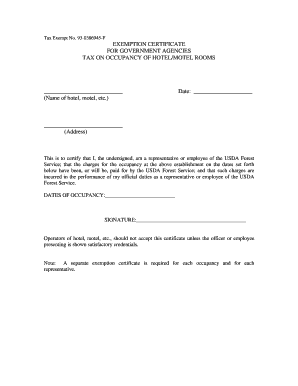

The 93 0386945 F is an exemption certificate for government agencies that need to certify tax exemption for hotel or motel room occupancy. This guide will provide step-by-step instructions on how to accurately complete this form online.

Follow the steps to successfully complete the tax exemption certificate.

- Press the ‘Get Form’ button to access the form and open it in your online document editor.

- Enter the name of the hotel, motel, or other establishment in the designated field. Ensure that the name is spelled correctly to avoid any complications.

- In the date field, input the date on which the occupancy occurs. This should reflect the specific date of your stay at the hotel or motel.

- Fill in the address of the establishment in the provided area. Ensure that all information is accurate as it will be used for verification.

- Clearly state the dates of occupancy in the specified section. This should encompass all the days for which the exemption applies.

- Sign your name in the signature field. Ensure that you are authorized to sign on behalf of the USDA Forest Service.

- After reviewing the form for completeness and accuracy, you can save your changes, download the document, print it for physical submission, or share it as needed.

Complete your forms online today!

OnlyFans does not typically issue a W-2 form to its creators because contributors are classified as independent contractors, not employees. Instead, you may receive a 1099 form to report your income for tax purposes. It’s essential to understand the differences between these forms to satisfy tax obligations correctly. Staying informed about specifics such as 93 0386945 F improves your compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.