Get 1036 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1036 Form online

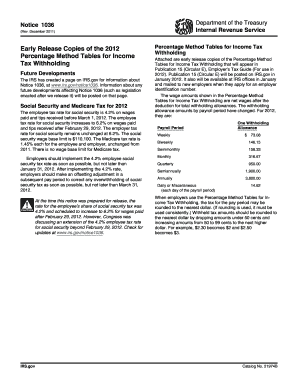

The 1036 Form serves as a critical document for employers to determine the correct amount of income tax withholding for their employees. This guide provides a step-by-step approach to aid users in filling out the form online, ensuring a smooth and efficient process.

Follow the steps to complete the 1036 Form effectively.

- Click ‘Get Form’ button to access the form and open it in the editing environment.

- Begin by entering your personal information, such as name and Employer Identification Number (EIN). This information is vital for tax identification.

- Review the wage details for your employees based on the applicable payroll period, such as weekly, biweekly, or monthly.

- Input the number of withholding allowances claimed by your employees to accurately calculate the withholding tax.

- Use the provided Percentage Method Tables to determine the appropriate tax withholding amounts depending on the employee's wages.

- Make any necessary adjustments for nonresident aliens if applicable, following the specific steps outlined for their withholding.

- Review the completed form thoroughly to ensure all information is accurate and all fields are filled appropriately.

- Once you are satisfied with the form, save your changes. You can choose to download, print, or share the document as needed.

Complete your documents online to ensure a hassle-free filing experience.

A 1036 form is a crucial piece of documentation that assists individuals in managing their tax-related affairs more effectively. By providing precise information relevant to your financial situation, this form helps in optimizing your tax return. Whether you are new to filing taxes or have experience, utilizing the 1036 form can enhance your understanding of tax responsibilities. Consider leveraging resources like uslegalforms to navigate the 1036 form with ease.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.