Loading

Get W9 Form Irs 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W9 Form Irs online

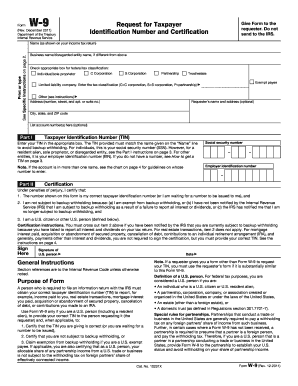

The W9 Form is a crucial document for individuals and entities in the United States that allows for the collection of taxpayer identification numbers needed for tax reporting. Filling out the W9 Form online is a streamlined process that can save time and ensure accuracy.

Follow the steps to complete the W9 Form online effectively.

- Click ‘Get Form’ button to access the W9 Form and open it in your preferred editing tool.

- Enter your name as shown on your income tax return in the designated field.

- If applicable, provide your business name or disregarded entity name in the corresponding section.

- Check the appropriate box that identifies your federal tax classification such as Individual/sole proprietor or Corporation.

- Fill out your address, including the street, city, state, and ZIP code.

- Enter your Taxpayer Identification Number (TIN) in the appropriate box. If you are an individual, this will typically be your social security number (SSN).

- Carefully read and complete the certification section, ensuring to cross out items if required, and provide your signature and date.

- Once all sections are filled out, review your entries for accuracy.

- Save your changes, and download or print the form as necessary for submission.

Complete your W9 Form online today to ensure timely processing and compliance.

Submitting a W9 Form has crucial implications for your taxes, as it provides necessary information for income reporting. When the requester processes your payments, they could issue tax forms based on your information on the W9. Keeping your information up to date ensures accurate reporting and tax compliance. Consider using platforms like US Legal Forms for easy W9 management.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.