Get Conventional Mortgage Underwriting Checklist 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Conventional Mortgage Underwriting Checklist online

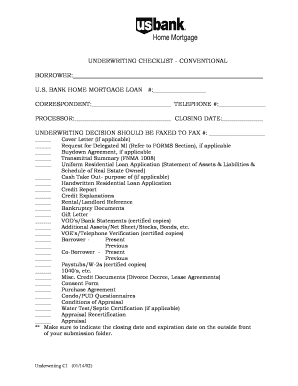

Completing the Conventional Mortgage Underwriting Checklist online is an essential step in securing a mortgage. This guide provides clear and detailed instructions to help you navigate each section of the form effectively.

Follow the steps to successfully complete the checklist.

- Click ‘Get Form’ button to obtain the checklist and open it in the appropriate editing environment.

- Begin by filling out the borrower section. Enter the U.S. bank home mortgage loan number, correspondent's name, and contact telephone number.

- Complete the processor's name and set the closing date for the transaction in the designated fields.

- Provide the fax number where the underwriting decision should be sent.

- If applicable, include a cover letter alongside other required documents such as the request for delegated mortgage insurance.

- Ensure the transmittal summary and uniform residential loan application are included and properly filled out.

- Detail any cash take-out purposes in the respective field, if applicable.

- Upload a handwritten residential loan application, credit report, and any necessary credit explanations.

- Provide rental/landlord references, bankruptcy documents, gift letters, and certified copies of bank statements and verification of deposits.

- Insert information regarding any additional assets or verification of employment, ensuring all documents are certified copies.

- Include paystubs, W-2s, and any additional income documents, ensuring they are certified.

- Mention any miscellaneous credit documents such as divorce decrees or lease agreements, if applicable.

- Attach any consent forms and purchase agreements needed for processing.

- Fill out condo or planned unit development questionnaires, appraisals, and any conditions related to the appraisal.

- If applicable, include water test and septic certification documents, followed by appraisal recertification documentation.

- Once all fields are completed accurately, ensure to indicate the closing date and expiration date on the outside front of your submission folder.

- Finally, save your changes, and choose to download, print, or share your completed checklist as needed.

Start completing your documents online today for a streamlined mortgage application process.

The C's in finance encompass character, capacity, and collateral, each playing a critical role in underwriting decisions. Character assesses the borrower's reliability according to their credit report and payment history. Capacity evaluates the borrower's income and ability to manage debt, while collateral examines the value of the property at stake. These elements are essential when you utilize a Conventional Mortgage Underwriting Checklist for a more thorough evaluation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.