Loading

Get N Deferred Annuity (spin Mmf0331au) 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the N Deferred Annuity (SPIN MMF0331AU) online

Filling out the N Deferred Annuity form online can be a straightforward process when guided correctly. This guide provides a detailed, step-by-step approach to assist you in completing the form accurately and efficiently.

Follow the steps to complete your N Deferred Annuity form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

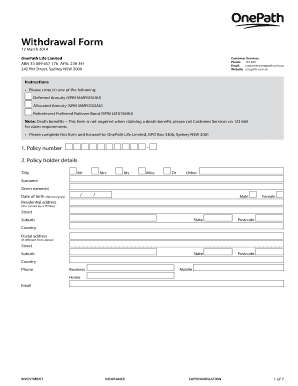

- Fill in your policy number at the top of the form. This number is essential for identifying your account.

- Provide your policy holder details, including your title (Mr, Mrs, Ms, Miss, Dr, or Other), surname, given names, and date of birth. Ensure the residential address is complete, with a street number, suburb, state, postcode, and country.

- Complete the rollover details. Indicate if you are rolling over total or partial amounts and specify the relevant figures before and after tax. Include the name of the rollover institution and their SPIN.

- If requesting a cash payment, fill in the total cash payment amount, either before or after tax. Specify if it’s a partial cash payment and provide any additional required details.

- For direct credit of cash payments to your financial institution, fill out their name, your account holder's name, BSB, and account number.

- Provide your tax file number (TFN) to avoid further taxation unless you choose to decline sharing it.

- If partial withdrawal is over $20,000, enclose your policy document. If it is lost or destroyed, complete the statutory declaration section.

- Sign and date the declaration, confirming the accuracy of the information provided and understanding the implications of your request.

- Once all sections are completed, review the form for accuracy and completeness, then save your changes, download, print, or share the form as needed.

Complete your N Deferred Annuity form online today for a seamless experience.

Yes, you can reverse an N Deferred Annuity (SPIN MMF0331AU) under certain conditions, often by selling it back or surrendering it. However, please note that reversing your annuity may incur fees, and might impact your overall financial strategy. Engaging with a knowledgeable resource like USLegalForms can provide the guidance you need for a well-informed decision.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.