Loading

Get Arkansas Border City Exemption Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arkansas Border City Exemption Form online

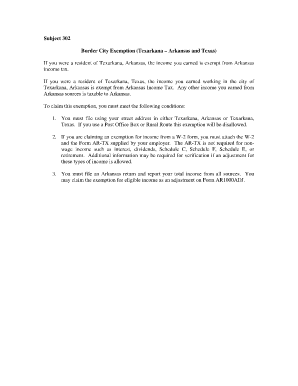

The Arkansas Border City Exemption Form allows residents of Texarkana, Arkansas, and Texarkana, Texas, to claim an exemption from Arkansas income tax on income earned in Texarkana. This guide provides clear, step-by-step instructions to help you fill out the form online effectively.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to download the exemption form and open it in the online editor.

- Begin by entering your street address in Texarkana, Arkansas, or Texarkana, Texas. Ensure that you do not use a Post Office Box or Rural Route, as this will result in disqualification of the exemption.

- If you are claiming the exemption for income reported on a W-2 form, attach your W-2 along with the Form AR-TX provided by your employer. Note that the AR-TX is not required for nonwage income such as interest, dividends, Schedule C, Schedule F, Schedule E, or retirement.

- Ensure you file a complete Arkansas return that includes your total income from all sources. Remember to claim the exemption for eligible income as an adjustment on Form AR1000ADJ.

- Once you have filled out all necessary information and attached any required documents, review the form carefully for accuracy. After reviewing, you can save changes, download, print, or share the form as needed.

Start completing your Arkansas Border City Exemption Form online today!

Yes, Texarkana is divided into two distinct cities: Texarkana, Arkansas, and Texarkana, Texas. This unique situation allows residents to benefit from different tax structures and services in both states. If you reside in one of these cities, the Arkansas Border City Exemption Form may offer you tax relief. Understanding this division can be advantageous for your financial planning.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.