Loading

Get Tomorrow's Scholar Forms 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tomorrow's Scholar Forms online

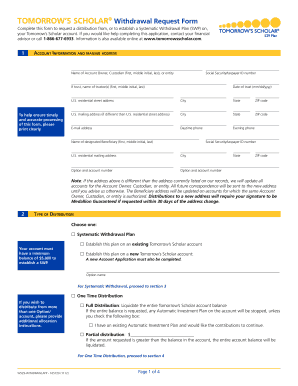

Filling out the Tomorrow's Scholar Forms online is a straightforward process designed to help you request distributions or establish a systematic withdrawal plan on your Tomorrow's Scholar account. This guide will provide step-by-step instructions to ensure you complete the forms accurately and efficiently.

Follow the steps to successfully complete your Tomorrow's Scholar Forms online.

- Click 'Get Form' button to obtain the Tomorrow's Scholar Forms and open it in your editor.

- Fill out the account information and mailing address section. Ensure that you enter the name of the account owner or custodian, Social Security or taxpayer ID number, and both residential and mailing addresses clearly.

- Indicate the type of distribution you are requesting by selecting either 'Systematic Withdrawal Plan' or 'One Time Distribution'. If opting for a systematic withdrawal, specify the payment amount and frequency.

- Complete the payment method section. Choose how you would like to receive your distribution, either by check, electronic transfer, or wire transfer. Ensure you provide any required bank information.

- Read and understand the agreement and signature section. Here, you will certify that the information provided is accurate and authorize the processing of your request. Make sure to sign and date the form.

- After completing the form, you can save your changes, download a copy, print it, or share it as needed. Ensure all required sections are completed before finalizing.

Begin filling out your Tomorrow's Scholar Forms online today for a smoother financial management experience.

The contribution may be made to an existing account you own, another Wisconsin account, or to a new account. For the 2023 tax year, the maximum deduction is $3,860 per year, per beneficiary ($1,930 for married filing separate status and divorced parents of a beneficiary).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.