Get Application For Refund Of Sales And Use Tax * - Dmv Virginia 2007-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the APPLICATION FOR REFUND OF SALES AND USE TAX * - Dmv Virginia online

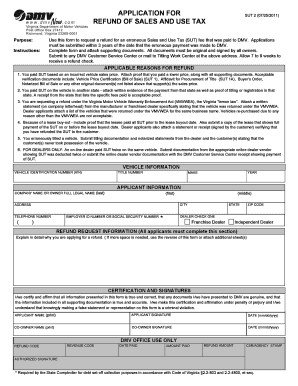

This guide provides clear and comprehensive instructions on how to fill out the Application for Refund of Sales and Use Tax from the DMV in Virginia. Whether you're a first-time user or seeking to streamline your document management process, this guide will help you navigate each section effectively.

Follow the steps to successfully complete the application online.

- Click the ‘Get Form’ button to access the application. This will allow you to obtain the necessary form to initiate the refund process.

- Begin by filling out the vehicle identification number (VIN) along with the vehicle’s title number. This information is crucial for identifying the vehicle related to the refund request.

- In the applicant information section, enter the full legal name of the applicant, which includes first, middle, and last name. Make sure to provide the current city, state, and zip code where you reside.

- Provide your telephone number, and if applicable, the employer ID number or social security number. This identification is necessary for processing your request.

- Next, indicate whether you are a franchise dealer or independent dealer. This information helps categorize your application appropriately.

- In the refund request information section, clearly explain the reason for your refund request. If you require more space, you can use the reverse side of the form or attach additional sheets.

- Complete the certification and signatures section. Both the applicant and co-owner (if applicable) must print their names, sign, and date the application, confirming that all information is accurate to the best of their knowledge.

- Lastly, review the form to ensure all fields are filled out correctly. After verification, save your changes, and proceed to download, print, or share the completed application as needed.

Take the next step and submit your application for refund online to ensure a timely resolution.

Yes, in Virginia, you must return your license plates when you no longer need them. This could happen if you decide to sell your vehicle or if your registration expires. Returning the plates helps prevent unauthorized use and potential liabilities, as well as ensuring a smoother process for any APPLICATION FOR REFUND OF SALES AND USE TAX - DMV Virginia you might consider.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.