Loading

Get Printable D 400v Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Printable D 400v Form online

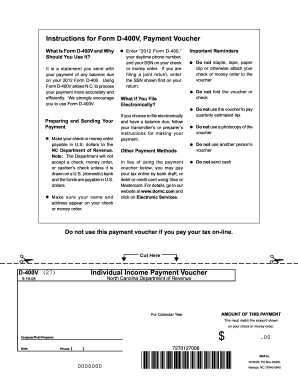

The Printable D 400v Form is essential for submitting your payment with a balance due on your 2012 Form D-400. This guide will provide you with clear, step-by-step instructions on how to accurately complete and submit this form online.

Follow the steps to complete the Printable D 400v Form online.

- Press the ‘Get Form’ button to access the Printable D 400v Form and open it in your preferred digital editor.

- Locate the section for your name and address on the form. It is crucial to ensure that this information matches your check or money order.

- Enter the total amount you wish to pay in the designated ‘AMOUNT OF THIS PAYMENT’ field, confirming it aligns with the amount on your payment.

- Provide your daytime phone number in the specified area of the form to ensure that you can be contacted if any issues arise.

- If you are part of a joint return, include the Social Security Number (SSN) of the first person listed on your return, as required.

- Double-check that all entered information is accurate and complete before finalizing your form.

- Once all fields are filled, you can save your changes, download a copy for your records, and print the form to mail it if needed.

- Ensure you do not staple, tape, or clip any attachments to the voucher and keep it flat without folding.

Complete your documents online to ensure a smooth processing experience.

N.C. tax filing D-400 refers to the primary tax form used by residents to file their personal income tax returns in North Carolina. It includes detailed information about your income, deductions, and credits applicable to your situation. Properly completing the D-400 form is crucial to fulfilling your tax obligations and ensuring you receive any tax refunds owed. You can select a Printable D 400v Form for ease of access when filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.