Get Occupancy Tax Form - Swain County - Swaincountync

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Occupancy Tax Form - Swain County - Swaincountync online

Filling out the occupancy tax form for Swain County is an important step for businesses operating within the region. This guide provides clear, step-by-step instructions to help you complete the form accurately and submit it on time, ensuring compliance with local regulations.

Follow the steps to complete your occupancy tax form efficiently.

- Press the ‘Get Form’ button to access the occupancy tax form digitally. This will allow you to fill out the form online with ease.

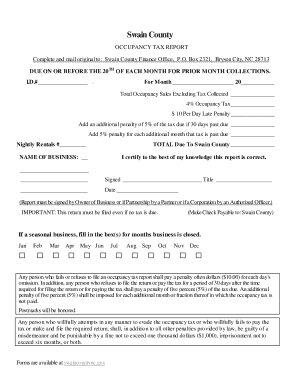

- Begin by entering your I.D. number in the designated field. This number is essential for identifying your business and its tax status.

- Indicate the month and year for which you are reporting occupancy sales. This is crucial for aligning your report with the correct tax period.

- Input the total occupancy sales excluding tax collected in the appropriate field. Be sure to calculate this accurately as it forms the basis of your tax liability.

- Calculate and enter the 4% occupancy tax owed on your total occupancy sales. This is a necessary component of the form and determines the tax you need to remit.

- If applicable, note any late penalty fees in the designated section. This includes a $10 per day late penalty for reporting after the due date.

- If your tax is more than 30 days overdue, calculate the additional 5% penalties for the overdue tax and enter those totals as well.

- Mention the number of nightly rentals your business managed during the reporting period.

- In the 'Total Due To Swain County' field, sum up all the amounts from the previous fields to calculate the total tax due.

- Provide the name of your business in the corresponding space.

- Sign and date the form to certify that the information provided is true and accurate. Ensure that it is signed by the appropriate individual according to your business structure.

- Before finalizing, review all entries and ensure that all necessary fields are filled correctly. After verification, you can save your changes online, download the form, or print it for submission.

Take action now by filling out your occupancy tax form online to ensure timely compliance with Swain County regulations.

In Texas, local occupancy tax rates can vary widely, typically falling between 6% to 9%. These taxes apply to hotel guests and are intended to fund local tourism initiatives. It is important to understand Texas's tax laws if you plan to travel or operate a property there, and the Occupancy Tax Form - Swain County - Swaincountync can help direct you to the right resources. Each city may have specific requirements, so be prepared.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.