Loading

Get Circle K W2 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Circle K W2 online

Filling out your Circle K W2 online is an essential step for accurately reporting your income and taxes. This guide provides clear and detailed instructions to assist you in completing the form efficiently and correctly.

Follow the steps to fill out your Circle K W2 accurately.

- Press the ‘Get Form’ button to access the W2 form and open it in your preferred editing tool.

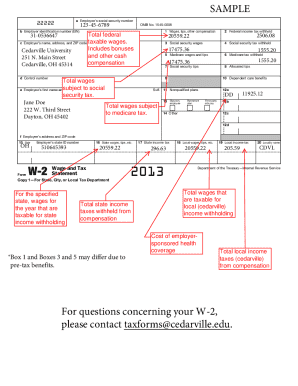

- In the top section, enter your employee information: provide your social security number, your employer's identification number (EIN), and the employer's name, address, and ZIP code.

- Fill in the control number if applicable, then complete your personal details by entering your first name, middle initial, last name, and your address along with your ZIP code.

- Proceed to report your earnings in the relevant boxes: Box 1 for wages, tips, and other compensation; Box 2 for federal income tax withheld; Box 3 for social security wages; Box 4 for social security tax withheld; Box 5 for Medicare wages and tips; and Box 6 for Medicare tax withheld.

- Complete Box 7 if you received tips, and fill in Box 8 for allocated tips if applicable. Further, address any dependent care benefits in Box 10, nonqualified plans in Box 11, and any required codes in Boxes 12a to 12d.

- Indicate if you are a statutory employee in Box 13, and note if you have a retirement plan or received third-party sick pay.

- Complete the state-related sections: enter your employer's state ID number in Box 15, fill in Box 16 for state wages, Box 17 for state income tax, Box 18 for local wages, and Box 19 for local income tax. Finish with the locality name in Box 20.

- Review all entries for accuracy, ensuring consistency in the information provided. Depending on your needs, you can then save any changes made, download, print, or share the completed form.

Ensure your tax filings are accurate by completing your Circle K W2 online today.

Circle K typically uses a payroll system that streamlines their employee compensation processes, including the generation of W-2s. This system ensures that employees receive their payments accurately and on time. For specific details, you might want to reach out to HR directly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.