Loading

Get Ncui101a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ncui101a online

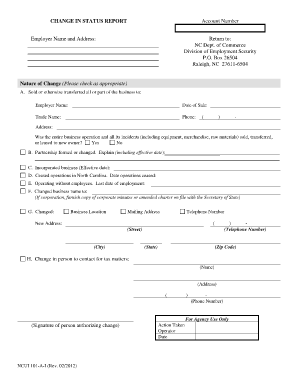

The Ncui101a form is essential for reporting changes in the business status to the appropriate authorities. This guide will provide you with detailed instructions on how to fill out the form digitally, ensuring a smooth and accurate submission process.

Follow the steps to complete the Ncui101a form accurately

- Click the ‘Get Form’ button to obtain the Ncui101a form and access it in your preferred digital format.

- Begin by filling out the employer name and address section. Enter the official name of your business and its physical address.

- Indicate the nature of the change by checking the appropriate box. There are several options, such as the sale or transfer of a business, formation of a partnership, or changing the business name.

- If you selected that the business was sold or transferred, provide the name of the new owner, the date of transfer, trade name, phone number, and complete address of the new owner.

- For any changes related to partnerships, corporations, or operational status, fill in those details as necessary, including effective dates and specific explanations.

- If there has been a change in location, mailing address, or telephone number, ensure to enter the new data accurately, including street, city, state, and zip code.

- You must also update the contact details for tax matters. Provide the name, address, and phone number of the designated contact person.

- Finally, review all entries for accuracy. Save your changes, and then you can choose to download, print, or share the Ncui101a form as needed.

Complete your Ncui101a form online today to ensure your business status is current and compliant.

Related links form

The formula for calculating gross earnings is simple: total your income streams and subtract non-applicable deductions. Specifically, add your wages, bonuses, and additional income; ensure to exclude taxes and retirement contributions. To clarify this process, Ncui101a provides practical examples that can help solidify your understanding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.