Get Dte Form 100 (ex) Statement Of Reason For Exemption ... 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DTE FORM 100 (EX) STATEMENT OF REASON FOR EXEMPTION online

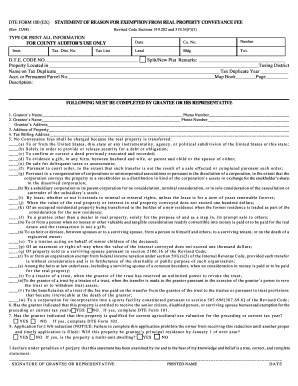

Filling out the DTE FORM 100 (EX) is a crucial step for individuals seeking an exemption from the real property conveyance fee. This guide provides a concise, step-by-step approach to completing the form online, ensuring that users can navigate the process with ease.

Follow the steps to complete the DTE FORM 100 (EX) with confidence.

- Click the ‘Get Form’ button to access the form and open it in your preferred digital editor.

- Fill in the required fields starting with the grantor's name in Line 1 as shown on the deed. This should include accurate spelling to match public records.

- In Line 2, input the grantee's name and their mailing address, ensuring that all information is precise for proper correspondence.

- Proceed to Line 3. Write the complete address of the property being conveyed, including street number and name.

- For Line 4, provide the full name and mailing address where tax bills should be sent. It's important to ensure this address is correct to avoid issues with property tax notifications.

- In Line 5, check the appropriate exemption type from the provided options (a) through (w). Review each option carefully to select the one that applies to your situation.

- Complete Line 6 if the grantor has indicated eligibility for a senior citizen, disabled person, or surviving spouse homestead exemption. If applicable, you must also then fill out DTE Form 101.

- For Line 7, confirm whether the property qualifies for current agricultural use valuation. If it does, complete DTE Form 102, and submit it alongside this statement.

- In Line 8, complete the application for the 2 ½% reduction only if the property is residential. Make sure to check if the property will be your principal residence by January 1 of the following year.

- Review all entered information for accuracy. After confirming that everything is correct, sign and date the form in the designated area, certifying the information is truthful.

- Once completed, you can save the form, download it for your records, print a physical copy, or share it as necessary.

Complete your documents online with ease and ensure your exemption is accurately filed.

In Ohio, several exemptions can potentially lower your property tax. These exemptions include the homestead exemption for seniors and disabled individuals, as well as tax abatement programs for new constructions or renovations. Additionally, properties owned by non-profit organizations may also qualify. To apply for these exemptions, you often need to submit a DTE FORM 100 (EX) STATEMENT OF REASON FOR EXEMPTION to the county auditor.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.