Get Payroll Deduction Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payroll Deduction Form online

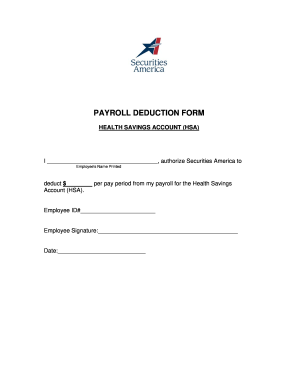

This guide provides clear and detailed instructions on how to complete the Payroll Deduction Form for a Health Savings Account online. Following these steps will ensure that you accurately fill out the form and submit it without any issues.

Follow the steps to accurately complete the Payroll Deduction Form.

- Click ‘Get Form’ button to obtain the Payroll Deduction Form and open it in the editor.

- In the first field, enter your name as it appears on your official records. Make sure to print it clearly to avoid any confusion.

- Next, provide the amount you wish to deduct from your payroll for the Health Savings Account. Write this amount in the designated field, ensuring it accurately reflects your intended contribution.

- In the Employee ID number field, enter your unique identification number as assigned by your employer. This step is crucial for processing your deduction accurately.

- You will need to sign the form in the employee signature area. Ensure that your signature matches the one on your official documents for verification purposes.

- Finally, input the date on which you are completing this form. This date helps in tracking your payroll deductions accurately.

- Once all fields are filled out, ensure to review your entries for any errors or omissions. After confirming accuracy, you can save changes, download, print, or share the completed form.

Complete your Payroll Deduction Form online to manage your Health Savings Account effortlessly.

The number of deductions you should claim for payroll depends on your personal financial situation, such as your income, dependents, and overall tax liability. Using the Payroll Deduction Form, evaluate what makes sense for your circumstances to optimize your withholdings. A higher number of deductions may lead to less tax withheld but can result in owing taxes at year-end. If you're unsure, consider consulting a tax professional for personalized advice.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.