Loading

Get Form Dte 105a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Dte 105a online

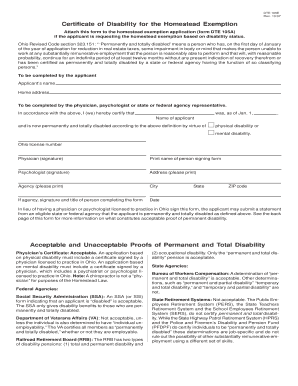

Filling out Form Dte 105a is an essential step for individuals seeking a homestead exemption based on disability status. This guide will provide you with clear and concise instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete the Form Dte 105a online for the homestead exemption

- Click the ‘Get Form’ button to access the document and open it in your browser's editing tool.

- Begin by entering your name in the appropriate field as the applicant.

- Provide your home address, ensuring that all details are accurate and complete.

- Have a qualified physician, psychologist, or representative from a state or federal agency fill out the certification portion of the form.

- Include the physician’s or psychologist’s name, signature, and Ohio license number to validate the certification.

- Specify the type of disability by marking the box for either physical or mental disability.

- Ensure that the person completing the form writes down their name, title, agency (if applicable), and contact information, including city, state, and ZIP code.

- If you are using a statement from a state or federal agency in lieu of a physician's signature, be sure to attach it to the application.

- Before finalizing, double-check that all sections are filled out correctly and save your changes. You may then download, print, or share the form as needed.

Start the process of filing your documents online today!

In 2025, the income limit for the homestead credit in Ohio is expected to be around $35,000. This limit determines eligibility for the property tax reduction benefit. Homeowners should ensure they complete the Form Dte 105a to confirm their income falls within this threshold and take full advantage of their entitlements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.