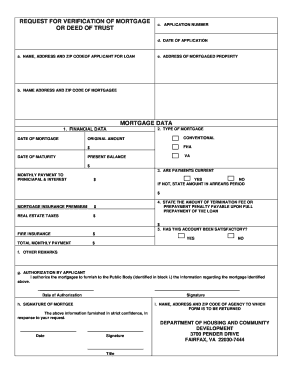

Get Verification Of Mortgage Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Verification Of Mortgage Form online

This guide will provide you with clear and supportive instructions on how to complete the Verification Of Mortgage Form online. Whether you are a seasoned user of digital forms or new to the process, this step-by-step approach will help you fill out the form accurately.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred digital workspace.

- In the first section, enter the application number and the date of the application clearly. This information helps track your request.

- Fill in your name, address, and ZIP code as the applicant for the loan. Ensure this information is accurate to avoid any processing delays.

- Provide the address of the mortgaged property. This helps verify the property associated with the mortgage.

- Enter the name, address, and ZIP code of the mortgagee. This is the institution or individual to whom the mortgage payment is made.

- In the mortgage data section, input the financial data, including the date of the mortgage and the date of maturity.

- Specify the type of mortgage, original amount, and present balance. Use the designated fields to select options such as conventional, FHA, or VA.

- Indicate whether payments are current. Select 'Yes' or 'No' and if payments are not current, include the amount in arrears and the period.

- Provide the monthly payment amount to principal and interest, mortgage insurance premium, and real estate taxes in the appropriate fields.

- State the amount of the termination fee or prepayment penalty payable upon full prepayment of the loan.

- Answer the question regarding whether this account has been satisfactory by selecting 'Yes' or 'No' and provide fire insurance details.

- Complete the 'Other Remarks' section if there are additional comments or information you wish to include.

- In the authorization by applicant section, sign and date your authorization allowing the mortgagee to provide the information to the specified public body.

- Obtain the signature of the mortgagee and complete their name, address, and title in the designated sections.

- Finally, review all the information for accuracy, then save your changes and choose to download, print, or share the form as needed.

Start filling out your Verification Of Mortgage Form online today for a streamlined process.

Related links form

A verification of a mortgage is a process in which a lender checks the details of an existing mortgage to confirm its status and terms. This can help in refinancing or purchasing a new home, as it assures the new lender of the borrower's payment history and obligations. Accurate verification is crucial to successful mortgage management. US Legal Forms can assist you in obtaining the necessary documentation for proper verification.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.