Get 1003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1003 online

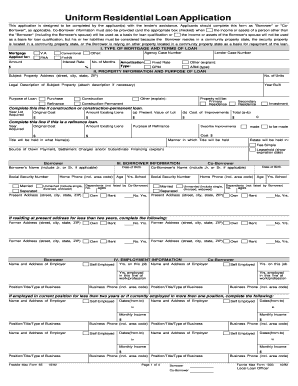

The 1003 form, also known as the Uniform Residential Loan Application, is an essential document used in the mortgage process. Completing this form accurately is crucial for loan approval. This guide provides step-by-step instructions to help you fill out the 1003 online effectively.

Follow the steps to complete the Uniform Residential Loan Application.

- Click ‘Get Form’ button to obtain the form and open it in your browser or document editor.

- In the first section, indicate the type of mortgage and terms of the loan. Select the appropriate type (e.g., V.A., Conventional, FHA) and fill in the desired loan amount and interest rate. Make sure to provide the agency case number if applicable.

- Next, provide property information. Enter the subject property address, number of units, and the year built. Specify the purpose of the loan, indicating whether it is for purchase, construction, refinance, etc. Additionally, denote if the property will serve as a primary residence, secondary residence, or investment.

- Proceed to the borrower information section. Enter the borrower's full name, date of birth, social security number, marital status, and current address. It is important to provide accurate information to avoid delays.

- If applicable, fill out the co-borrower's information in the same manner as the borrower. This includes their personal details and current housing status.

- In the employment information section, list the current employer's name and address for both borrower and co-borrower. Specify any self-employment status and provide details about their job title and duration.

- Detail your monthly income and combined housing expense information. Accurately report all sources of income and the combined monthly expenses, listing any relevant liabilities.

- Complete the assets and liabilities section, carefully documenting all assets, account information, and debts. Ensure that this information is precise as it can significantly impact your loan qualification.

- Address any additional details of the transaction, providing specifics on the purchase price, improvements, and estimated costs associated with the loan.

- Finally, review and sign the acknowledgment and agreement section. Ensure that all the information provided is accurate and reflects your current financial situation. Once completed, save changes, download, print, or share the form as needed.

Complete your 1003 online accurately to expedite your loan process.

The 1003 form is a critical document used in the mortgage application process. It collects various details about the borrower, their income, asset holdings, and the property being financed. By using the 1003 form, both lenders and borrowers can streamline the approval process. If you're looking for a platform that simplifies this process, USLegalForms can provide you with the necessary tools and resources to manage your 1003 form and other related documents efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.