Loading

Get Accounts Receivable - Contract To Sale 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Accounts Receivable - Contract To Sale online

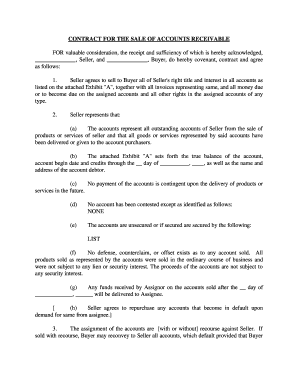

Completing the Accounts Receivable - Contract To Sale online is a crucial activity for facilitating the sale of accounts between a seller and a buyer. This guide provides you with step-by-step instructions to ensure that you fill out the form accurately and effectively.

Follow the steps to complete the online form successfully.

- Press the ‘Get Form’ button to access the Accounts Receivable - Contract To Sale online form and open it in the editor.

- Enter the name of the seller in the designated field, ensuring accuracy and clarity.

- Input the buyer's name as specified in the corresponding area of the form.

- Refer to Exhibit 'A' when detailing the accounts being sold, ensuring that all account details are complete and accurate.

- In the section where the seller's representations are listed, confirm that all statements about the accounts are true and complete, including any details about future payment contingencies.

- Indicate whether there are any contested accounts by filling in the relevant information, or state 'NONE' if applicable.

- Detail any security interests or indicate if the accounts are unsecured, providing the necessary information.

- Clarify the recourse agreement in the appropriate section, selecting whether the sale is with or without recourse.

- Set the timeframe for the buyer's inspection period and ensure it is clearly specified.

- Conclude the form by signing and dating it in the seller and buyer sections, confirming the agreement of both parties.

- Once all sections are filled out, save changes to the document, and proceed to download, print, or share the completed contract as needed.

Complete your Accounts Receivable - Contract To Sale online now for efficient documentation.

Selling accounts receivable to a third party financial institution at a discount is known as accounts receivable financing. In this case, businesses receive a percentage of the invoice amount upfront, while the financial institution collects the full amount from the customer later. This practice helps companies access funds quickly, improving liquidity and operational flexibility.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.