Loading

Get Sample Tax Return 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sample Tax Return online

This guide provides step-by-step instructions on how to complete the Sample Tax Return online. Designed for users with varying levels of experience, this resource aims to simplify the process and ensure the accurate submission of your tax return.

Follow the steps to fill out the Sample Tax Return online.

- Press the ‘Get Form’ button to access the Sample Tax Return form and open it in the designated editor.

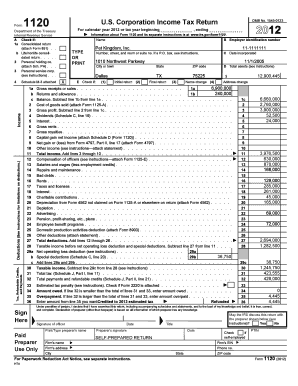

- In the 'Tax year' field, enter the tax year for which the return is being filed, specifying the beginning and ending dates if applicable.

- Fill in the 'Name' and 'Employer identification number' for the business, ensuring that all information is accurate.

- Indicate the type of return by checking the appropriate box, such as 'Initial return' or 'Final return'.

- Complete the income section by entering gross receipts or sales and any returns or allowances to calculate the balance.

- For deductions, carefully input all applicable amounts, including compensation of officers, salaries, and expenses, ensuring you calculate the total accurately.

- Compute the taxable income by subtracting the total deductions from total income. This amount will be critical for determining the tax liability.

- Fill out the tax and payments section to indicate any taxes owed or overpayments, and ensure that your calculations align with your deductions.

- Finalize the return by signing and dating the form. If the return was prepared by someone other than the filer, include their information as well.

- After reviewing all entries for accuracy, save your progress, and download or print for your records and possible electronic submission.

Encourage others to complete their tax documents online for a faster and streamlined filing process.

To maximize your tax refund as a self-employed individual, track all business-related expenses and keep detailed records. Deductions for expenses can significantly lower your taxable income. You may also want to use a sample tax return to guide you through filing or consult platforms like USLegalForms for resources tailored to self-employed filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.