Loading

Get Indiana State Form 38220 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Indiana State Form 38220 online

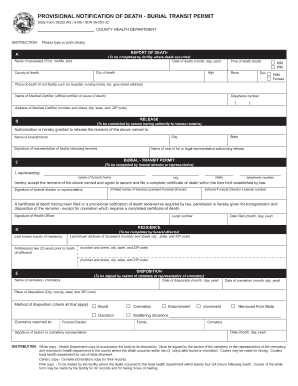

Filling out the Indiana State Form 38220, the provisional notification of death and burial transit permit, is an essential process following a death. This guide provides clear, step-by-step instructions for completing the form online, ensuring that users can navigate each section with ease.

Follow the steps to complete the Indiana State Form 38220 online.

- Press the ‘Get Form’ button to obtain the form and open it in your digital editor.

- In the 'Report of Death' section, enter the date of death, the name of the deceased (first, middle, last), their age, city, and county of death, time of death, race, and sex. Ensure all entries are typed or printed clearly.

- Complete the 'Place of Death' field with the facility name or street address if the death did not occur in a medical facility. Next, provide the name and telephone number of the medical certifier, along with their address.

- In the 'Release' section, authorize the release of remains by entering the name of the funeral home, along with its city and state. Include the signature of the facility representative, as well as the name of the next of kin or legal representative authorizing the release.

- Fill out the 'Burial - Transit Permit' section by entering your name as the funeral director or representative, along with the funeral home details. Provide your telephone number, printed name, signature, and Indiana funeral director license number.

- If applicable, complete the section regarding the permission for transportation and disposition of remains. Include the signature of the health officer, their local number, and the date filed.

- In the 'Residence' section, provide the last known county and address of the deceased, as well as any addresses from the last two years prior to death.

- For the 'Disposition' section, enter the date of disposition and name of the cemetery or crematory. Provide the date of cremation (if applicable), the place of disposition, and check all applicable methods of disposition. Ensure the signature of the sexton or crematory representative is included.

- Review all sections for accuracy. Once completed, save your changes. You can then download, print, or share the form as needed.

Ensure proper documentation by completing the Indiana State Form 38220 online today.

The Oversight Committee on Public Records functions as the policy-making body for the Administration, and consists of the Governor, the Secretary of State, the State Examiner for the State Board of Accounts, the Director of the State Library, the Director of the Historical Bureau, the Director of the Archives and ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.