Get Illinois Withholding Allowance Worksheet How To Fill It Out

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Illinois Withholding Allowance Worksheet online

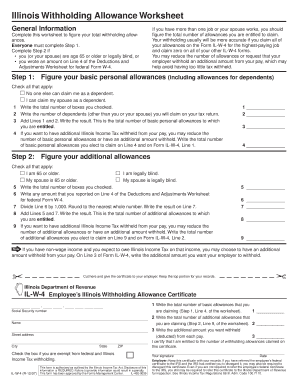

Filling out the Illinois Withholding Allowance Worksheet is essential for ensuring that your employer withholds the correct amount of Illinois Income Tax from your pay. This guide provides clear, step-by-step instructions tailored for users of all experience levels to successfully complete this worksheet online.

Follow the steps to accurately complete the Illinois Withholding Allowance Worksheet.

- Click the ‘Get Form’ button to access the Illinois Withholding Allowance Worksheet. This will allow you to obtain the form and open it in your chosen editor.

- Begin by completing Step 1 to determine your basic personal allowances. Check all applicable boxes that indicate who can claim you as a dependent and any dependents you will claim on your tax return. Write the totals for Lines 1, 2, and 3, and then enter the total number of basic personal allowances you wish to claim on Line 4.

- Proceed to Step 2 to calculate any additional allowances. Check the boxes for eligibility, such as age or blindness for you or your spouse. Complete Lines 5, 6, 7, and 8 accordingly, and enter the total number of additional allowances you wish to claim on Line 9.

- If applicable, specify any additional amount you wish to have withheld from your pay due to non-wage income on Line 3 of the IL-W-4 form.

- Once all sections are completed, review your entries for accuracy. You can save your changes, download, print, or share the completed form as needed.

Complete your documents online today to ensure accurate tax withholding.

Determining the best number of allowances to claim on your W4 requires careful consideration of your financial situation. Many people find that claiming two or three allowances balances their withholding effectively without leading to a tax bill. The Illinois Withholding Allowance Worksheet How To Fill It Out provides guidance, making it easier to navigate this decision and optimize your tax withholding.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.