Loading

Get Etax Bermuda

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Etax Bermuda online

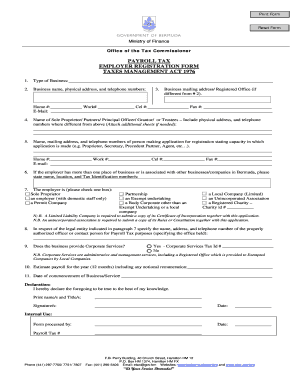

Filling out the Etax Bermuda form online is an essential step for businesses to register their payroll tax. This guide will provide you with clear instructions to ensure a straightforward process.

Follow the steps to complete and submit your registration form effectively.

- Click ‘Get Form’ button to acquire the form and open it in the designated editor.

- In the first field, indicate the type of business you are registering. Make sure to provide a clear description.

- Fill in the business name, physical address, and telephone numbers accurately in the following section.

- If your mailing address or registered office differs from the physical address, provide that information in the next field.

- Input home, work, and cell phone numbers along with the fax number and email address. Be precise with each detail.

- List the names, physical addresses, and contact numbers of the sole proprietor, partners, principal officers, grantors, or trustees. Attach additional sheets if necessary.

- Specify the name, mailing address, and phone numbers of the person submitting the application, including their capacity (e.g., proprietor, secretary).

- If applicable, mention any other places of business or associated businesses in Bermuda, along with their names, locations, and tax identification numbers.

- Check the appropriate box to indicate the legal entity type (e.g., sole proprietor, partnership, etc.). Ensure that the selected option matches your business structure.

- Provide the name and contact details of the authorized officer for Payroll Tax purposes.

- Indicate whether the business provides Corporate Services and provide the Corporate Services Tax ID if applicable.

- Estimate the payroll amount for the upcoming year, including any notional remuneration.

- Record the date your business or service commenced.

- Finally, review all entries for accuracy, print the document, and sign it along with your title. Enter the date of your signature.

- Save your changes, download the completed form, and print it if necessary for submission.

Start filling out your document online today for a seamless experience.

Self-employed individuals in Bermuda enjoy a unique tax structure, as there is no self-employed tax imposed. Instead, they may face a payroll tax that applies to employees, but this does not extend to self-employed workers. This allows entrepreneurs to reinvest their earnings without the burden of traditional income taxes. For comprehensive understanding of tax regulations, many seek guidance from Etax Bermuda.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.