Get Texas Sales And Use Tax Exemption Certification - University Of ... - Uhv

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Sales And Use Tax Exemption Certification - University Of Houston-Victoria online

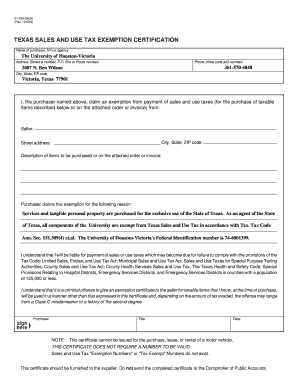

Filling out the Texas Sales And Use Tax Exemption Certification is essential for qualifying for tax exemptions on eligible purchases made by the University of Houston-Victoria. This guide will provide clear, step-by-step instructions to assist you in completing the form online efficiently.

Follow the steps to complete the certification form seamlessly.

- Press the ‘Get Form’ button to access the Texas Sales And Use Tax Exemption Certification form and open it in your preferred editor.

- Begin by entering the name of the purchaser, firm, or agency at the top of the form. In this case, write 'The University of Houston-Victoria'.

- Fill in the address section with the street address, including any necessary details such as a P.O. Box or route number. Use the format: 3007 N. Ben Wilson, Victoria, Texas, 77901.

- Provide the telephone number in the designated area, ensuring you include the area code. The contact number is 361-570-4848.

- Identify the seller by entering their name, city, state, and ZIP code in the specified fields.

- In the section for the description of items to be purchased, clearly itemize the taxable items included in your order or invoice.

- State the reason for claiming the exemption. Indicate that the exemption is applicable as services and tangible personal property are purchased for the exclusive use of the State of Texas.

- Enter the federal identification number for the University, which is 74-6001399, in the appropriate section.

- Sign and date the form in the designated area to certify the information is accurate and complete.

- Once the form is filled out, you may save changes, download, print, or share the completed form as needed.

Complete your Texas Sales And Use Tax Exemption Certification online today to ensure compliance and accuracy.

Obtaining a Texas sales and use tax permit involves applying through the Texas Comptroller's office, either online or via paper forms. You'll provide information about your business operations and the types of goods or services you offer. The process aligns with the Texas Sales And Use Tax Exemption Certification - University Of ... - Uhv to ensure you understand your obligations and rights as a seller. Once approved, this permit allows you to legally collect sales tax from customers.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.