Get Roth 457b Scpeba

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Roth 457b Scpeba online

Filling out the Roth 457b Scpeba form is an essential process for individuals seeking to manage their retirement savings effectively. This guide aims to provide detailed, step-by-step instructions to assist users in completing this form online, ensuring clarity and comprehension throughout the process.

Follow the steps to successfully complete the Roth 457b Scpeba form online.

- Press the ‘Get Form’ button to access the Roth 457b Scpeba document and open it in your online editor.

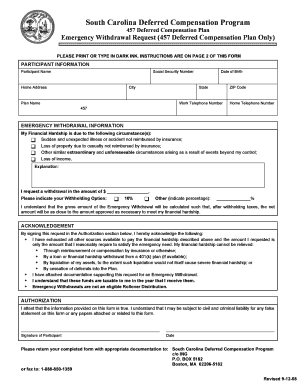

- Fill in the participant information section accurately. This includes providing your full name, Social Security number, home address, city, state, ZIP code, date of birth, and both home and work telephone numbers.

- In the emergency withdrawal information section, clearly state your financial hardship by selecting one of the given circumstances and providing an explanation if required.

- Indicate the amount you are requesting to withdraw in the designated field and choose your withholding option, ensuring you understand the implications of the selected percentage.

- Review the acknowledgment section carefully. Check the boxes to confirm you have exhausted all available resources and understand the tax implications of your withdrawal.

- Sign and date the authorization section to certify the accuracy of the information provided.

- Once all sections are completed, you can save your changes, download the completed form, or print it for your records. Ensure you include any required documentation before submitting.

Complete the Roth 457b Scpeba online today to take control of your financial future.

Discussing whether to roll over your 457 to an IRA on platforms like Reddit can provide diverse perspectives, but it's crucial to make an informed decision based on your circumstances. A rollover may offer benefits such as more investment choices and enhanced flexibility. However, consider consulting with a financial advisor to understand all implications. Uslegalforms can also provide resources to help you through this important decision.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.