Loading

Get Irs Form 8606 For 1995

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 8606 for 1995 online

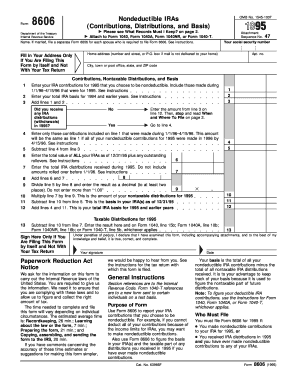

Filling out the IRS Form 8606 for 1995 can seem complex, but with this comprehensive guide, you'll be able to navigate each section with clarity. This form is essential for reporting your nondeductible IRA contributions and calculating your IRA basis.

Follow the steps to efficiently complete your IRS Form 8606 for 1995.

- Click the ‘Get Form’ button to access the IRS Form 8606 for 1995. Once you have obtained the form, open it in your preferred editing tool.

- Fill in the name and social security number at the top of the form. If married, ensure that each spouse who needs to file a Form 8606 completes a separate form.

- Enter your home address as requested. If you are submitting this form without a tax return, ensure to provide a complete address.

- For line 1, provide your IRA contributions for 1995 that you are choosing to classify as nondeductible. Include contributions made between January 1, 1996, and April 15, 1996, that are for the year 1995.

- On line 2, input your total IRA basis from 1994 and previous years to maintain an accurate record.

- Add the amounts from lines 1 and 2 and enter the result on line 3.

- If you did not receive any IRA distributions in 1995, enter 'No' and continue to line 12. If you did, proceed to line 4.

- For line 4, indicate your IRA contributions included on line 1 that were made during the period from January 1, 1996, to April 15, 1996.

- Subtract line 4 from line 3 and enter the result on line 5.

- For line 6, provide the total value of all your IRAs as of December 31, 1995, including any outstanding rollovers.

- Enter the total IRA distributions received during 1995 on line 7, excluding amounts rolled over before January 1, 1996.

- Add lines 6 and 7, and enter the total on line 8. Then, divide line 5 by line 8 to determine the nontaxable portion of your distributions.

- Multiply line 7 by the decimal from line 9 to find the amount of your nontaxable distributions for 1995 and enter it on line 10.

- Subtract line 10 from line 5 to find your IRA basis as of December 31, 1995, and enter the result on line 11.

- Finally, add lines 4 and 11. This total represents your overall IRA basis for 1995 and previous years, and enter it on line 12.

- If you are filing Form 8606 by itself, sign and date the form. Ensure all information is complete and accurate before submission.

- Once all fields are filled out, you may save your changes, download a copy of the completed form, or print and share it as needed.

Complete your IRS Form 8606 for 1995 online and ensure your tax filings are accurate and up-to-date.

Filing IRS Form 8606 for previous years involves completing the form as you would for the current year, ensuring you indicate the correct tax year. After filling it out, you must submit it along with your other tax forms for that year. For ease and accuracy, consider using US Legal Forms, which provides templates and clear instructions for filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.