Get Transfer On Death Plan. Use This Form To Transfer Ownership Of Your Vanguard Accounts Directly To 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Transfer On Death Plan: Use This Form To Transfer Ownership Of Your Vanguard Accounts Directly To online

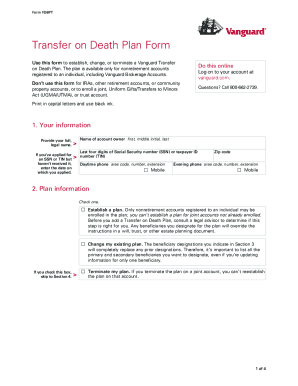

The Transfer On Death Plan allows you to designate beneficiaries for your Vanguard accounts, ensuring your assets are transferred outside of probate. This guide provides a clear, step-by-step approach to completing the form online, aimed at assisting users of all experience levels.

Follow the steps to fill out the Transfer On Death Plan successfully.

- Click ‘Get Form’ button to access the Transfer On Death Plan form. Open it in your designated editing environment.

- In 'Your Information,' fill in your full legal name and last four digits of your Social Security number or taxpayer ID number. Include your daytime and evening phone numbers along with your zip code.

- For 'Plan Information,' check the appropriate option to either establish, change, or terminate the plan. If establishing or changing, ensure to review the implications thoroughly.

- Under 'Accounts to be included in the plan,' choose either all your nonretirement accounts, all joint tenant accounts already enrolled, or specific accounts you wish to include. Provide necessary account numbers as requested.

- In 'Beneficiaries you want to designate,' list your primary beneficiaries. Specify the percentage of assets each primary beneficiary will receive, ensuring the total equals 100%. Repeat for secondary beneficiaries, with similar instructions regarding percentage allocation.

- Sign the form in the 'Authorization of account owner(s)' section. Ensure that you date your signature and print your name as requested.

- Make a copy of your completed form for your personal records. Mail your completed form and any attached documents in the provided postage-paid envelope to Vanguard.

Start the process online today to establish your Transfer On Death Plan and secure your asset transfers.

Transferring a Vanguard account to another person is generally possible but involves specific procedures. This process requires fluid communication between both parties and proper documentation to secure the transfer. Using a Transfer On Death Plan makes it easier to assign your accounts to beneficiaries upon your passing, avoiding the hassle of transferring ownership while you are alive. Consult Vanguard’s guidelines for details on the transfer process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.