Get Reaffirmation Agreement Form Student Loans 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Reaffirmation Agreement Form Student Loans online

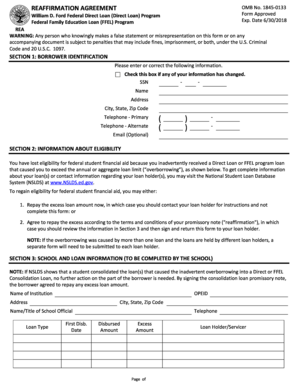

Filling out the Reaffirmation Agreement Form for Student Loans is a crucial step in regaining eligibility for federal financial aid. This guide provides clear instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the form successfully.

- Press ‘Get Form’ button to access the Reaffirmation Agreement Form and open it for editing.

- In Section 1, provide your borrower identification information. Enter your Social Security Number, name, address, city, state, zip code, primary and alternate telephone numbers, and an optional email address. If any of your information has changed, check the corresponding box.

- In Section 2, review the eligibility information. Understand that you can either repay the excess loan amount or agree to reaffirm it. Make your choice based on the options provided.

- In Section 3, your school will fill in the name of the institution, OPEID, address, city, state, zip code, name/title of the school official, loan type, first disbursement date, disbursed amount, and excess amount. Ensure this information is accurately recorded.

- In Section 4, read through the request, understandings, promise to pay, and authorization. Carefully review each point and acknowledge your understanding by signing and dating where indicated.

- In Section 5, check the address provided for where to send the completed form. If no address is shown, ensure it's sent to your loan holder.

- Double-check all your entries for accuracy. When the form is filled out correctly, you may save your changes, download, print, or share your completed Reaffirmation Agreement Form.

Take action now and complete the Reaffirmation Agreement Form online to regain your eligibility for federal student financial aid.

Reaffirmation is important because it helps you maintain your creditworthiness and keeps your student loans active during bankruptcy. This action can prevent the annoyance of sudden collection practices from lenders. By utilizing a Reaffirmation Agreement Form for Student Loans, you can clarify your responsibility and create a plan for repayment, which can be beneficial for your financial future.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.