Get Cf 377 7c Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cf 377 7c Form online

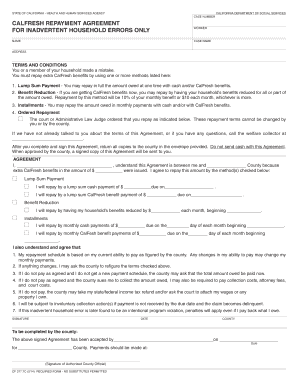

Filling out the Cf 377 7c Form online is an important step for users who need to arrange repayment of extra CalFresh benefits due to inadvertent household errors. This guide will walk you through the process, ensuring that you complete each section accurately and efficiently.

Follow the steps to successfully complete the Cf 377 7c Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your case number at the top of the form. This information allows the county to identify your case accurately.

- Next, provide your name under the 'NAME' section. Ensure that you spell your name correctly as it appears in official documents.

- Fill out the 'CASE NAME' field with the relevant case name associated with your benefits.

- In the 'ADDRESS' section, input your current address. This is important for any correspondence regarding your repayment agreement.

- Review the 'TERMS AND CONDITIONS' section. Make sure you understand the repayment methods available to you, whether it be a lump sum, benefit reduction, or installments.

- Under the 'AGREEMENT' section, enter the total amount of extra benefits issued in the space provided. Check the repayment method(s) you wish to use.

- If opting for a lump sum payment, fill in the amount and due date as specified in the form. For benefit reduction, provide the amount and start date.

- For installment payments, detail the amount you will pay monthly and the due date, choosing whether payments will be through cash or CalFresh benefits.

- Read and acknowledge the terms regarding changes in your ability to pay and the consequences of non-payment by initialing next to each point.

- Complete the 'SIGNATURE' section with your signature and the date to finalize your agreement.

- Finally, review all your entries for accuracy and ensure that you have completed every required field. You can then save your changes, download, print, or share the form as necessary.

Complete your documents online today to ensure your repayment agreement is processed smoothly.

Filling out the CA 540 form involves several steps, including gathering income information and deductions. Start by accurately entering your personal details and income sources, then work through the deductions and credits. The Cf 377 7c Form can serve as a useful reference for various tax details you might need. Finally, review your completed form to ensure there are no mistakes before submission.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.