Loading

Get Formulario 8862 Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Formulario 8862 Irs online

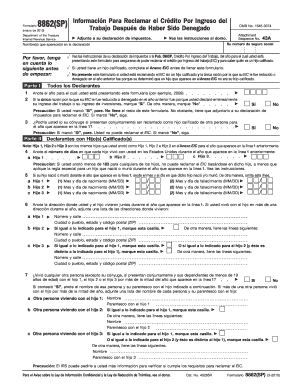

The Formulario 8862 is used to claim the earned income credit after it has been denied. This guide will provide clear and concise instructions to help you fill out the form online, ensuring you meet all the necessary requirements.

Follow the steps to complete the Formulario 8862 Irs online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Social Security number in the designated field. This number is essential for identification purposes.

- Provide the name(s) as they appear on your tax declaration. Ensure that this is consistent with what is recorded with the IRS.

- Indicate the year for which you are submitting this form by writing it in the appropriate section.

- Answer question 2 regarding the reason your earned income credit (EIC) was reduced or denied. If the only reason was an error regarding your work or investment income, mark 'Yes' and stop here, as you will still need to attach this form to your tax return.

- For question 3, indicate whether you or your spouse could be claimed as a qualifying child by another taxpayer for the year specified. Mark 'Yes' or 'No' accordingly.

- If you have qualifying child(ren), proceed to Part II. In line 4, record the number of days each qualifying child lived with you in the U.S. during the specified year, ensuring the count is 183 days or more for eligibility.

- If any child was born or died during the year, provide the month and day of the event in lines 5 and 6. If multiple children are listed, make sure to differentiate their information.

- Complete the address fields for where you lived with the child(ren) throughout the year, and ensure they match the details provided in your earned income credit application.

- If applicable, answer question 7 regarding any other individuals who lived with your qualifying child(ren) for more than half the year, listing names and relationships.

- For users without qualifying children, complete Part III by noting the number of days you and your spouse, if applicable, lived in the United States during the tax year.

- Once all fields are completed, review your entries to ensure accuracy. Save your changes, then download, print, or share the completed form as needed.

Complete your Formulario 8862 online today to ensure you can claim your eligible tax credits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing Form 8862 is essential if you want to reclaim the Earned Income Tax Credit after a previous denial. This form allows you to confirm your eligibility and restore your benefits. By completing Formulario 8862 Irs, you take an important step toward maximizing your tax refunds.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.