Get Consolidated Monthly Taxes Form Only - Eng 01072008.doc - Mof Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Consolidated Monthly Taxes Form Only - Eng 01072008.doc - Mof Gov online

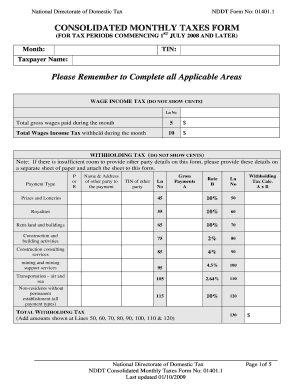

This guide provides a clear and user-friendly approach to completing the Consolidated Monthly Taxes Form Only. Follow the steps outlined below to ensure accurate and timely filing of your taxes online.

Follow the steps to fill out the Consolidated Monthly Taxes Form only.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the month for which you are filing the taxes in the specified field. This is essential for identifying the relevant tax period.

- Fill in your Taxpayer Identification Number (TIN) in the designated area. Ensure that this number is accurate to avoid processing delays.

- Provide your full name in the Taxpayer Name section. This should match the name associated with your TIN.

- Complete the Wages Income Tax section by entering the total gross wages paid during the month in line 5, and the total wages income tax withheld in line 10.

- For Withholding Tax, indicate the payment type (P or R) in the corresponding field, and include the name, address, and TIN of the other party in the appropriate lines. Enter the gross payments and applicable tax rates based on the services provided.

- Calculate the total withholding tax by adding the amounts shown in the specified lines (50, 60, 70, 80, 90, 100, 110 & 120), and record the total in line 130.

- In the Services Tax section, provide total sales figures for the relevant service types and calculate the services tax payable by multiplying the total by 5%. Enter this amount in line 40.

- If applicable, fill in the Annual Income Tax Installment Payments based on your total turnover for the specified month or quarter, following the guidelines provided.

- Provide your TIN, month, and year in the Payment Advice section, and enter the corresponding amounts for wages tax, withholding tax, services tax, and income tax installment.

- Complete the Declaration section by signing and dating the form. Also, include your telephone number for contact purposes.

- Finally, review your completed form for accuracy. Once satisfied, save any changes, and you can download, print, or share the form as required.

Start filling out your Consolidated Monthly Taxes Form online today for a seamless filing experience.

The New Mexico tax form typically refers to the Personal Income Tax Form PIT-1, which residents use to file their state income tax to the New Mexico Taxation and Revenue Department. This form must be completed accurately to reflect your income and any applicable deductions. Ensure that you maintain all supporting documents when filing. For a thorough understanding, check out the Consolidated Monthly Taxes Form Only - Eng 01072008.doc - Mof Gov as a reliable resource.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.