Get Transfer Of Inheritance 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Transfer Of Inheritance online

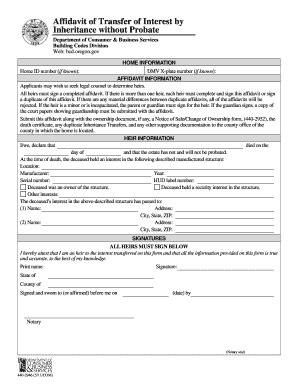

The Transfer Of Inheritance form is used to document the passing of interest in a property without going through probate. This guide provides a clear, step-by-step approach to help you fill out this form online, ensuring you understand each component involved in the process.

Follow the steps to complete the Transfer Of Inheritance form online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the home information, including the home ID number and DMV X-plate number, if you have them.

- Proceed to the Affidavit Information section. Read the instructions regarding heirs carefully to ensure all necessary signatures are included. Remember that if there is more than one heir, each of them must complete and sign the affidavit or sign duplicate copies.

- Fill in the details of the deceased under the Heir Information section. You will need to provide the date of death and confirm that the estate will not be probated.

- Specify the details of the manufactured structure, including its location, manufacturer, year, serial number, and HUD label number.

- Identify the heirs who will receive the interest. Enter the names and addresses of all heirs in the designated areas.

- Ensure that all heirs sign the document in the designated area, affirming their status as heirs and the accuracy of the information provided.

- Add notary information where required. You will need to sign and date the document in the presence of a notary, who will then provide their seal.

- Once all sections are completed accurately, save your changes. You can then download, print, or share the completed Transfer Of Inheritance form as needed.

Start completing your Transfer Of Inheritance form online today.

Filling out IHT402 involves reporting your liability and any exemptions that apply to your inheritance. Begin by gathering all necessary information needed for the form, such as details of the estate and beneficiaries. Follow the instructions closely to ensure accurate completion, as errors can cause delays in the transfer of inheritance. If you need assistance, consider accessing U.S. Legal Forms for templates and guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.