Loading

Get California Tax Table 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the California Tax Table online

This guide provides step-by-step instructions on how to fill out the California Tax Table. It is designed to assist users, regardless of their familiarity with tax forms, in accurately determining their tax obligations through an easy online process.

Follow the steps to accurately complete the California Tax Table.

- Click 'Get Form' button to obtain the California Tax Table and open it in the editor.

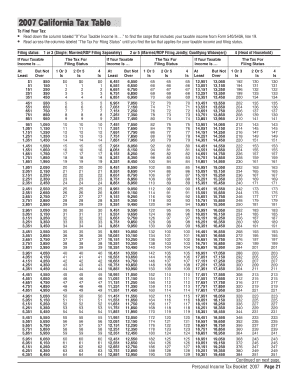

- Locate the column labeled 'If your taxable income is...' and identify your taxable income range based on the information from Form 540/540A, line 19.

- Look across the columns labeled 'The Tax For Filing Status' that correspond to your filing status. This could be 'Single,' 'Married/RDP Filing Separately,' 'Married/RDP Filing Jointly' or 'Head of Household'.

- Once you identify your taxable income range and corresponding tax amount, note the figure next to your filing status.

- After gathering your tax information, you can save changes, download, print, or share the completed form as needed.

Start completing your California Tax Table online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If your income reaches $1 million in California, you can anticipate a state tax liability of approximately $100,000 to $120,000. The tax is structured progressively, meaning that higher income levels face increased tax rates. Check the California Tax Table for exact rates as they apply to your unique circumstances.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.