Loading

Get Form 940

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 940 online

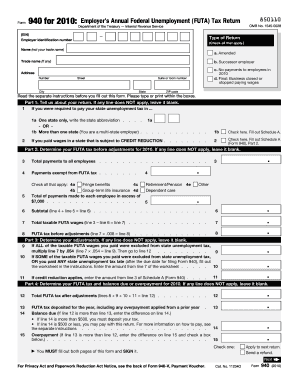

Filling out the Form 940 online is an essential task for employers to report their annual federal unemployment tax liability. This guide provides comprehensive, step-by-step instructions to help users navigate the form with ease.

Follow the steps to successfully complete the Form 940 online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Input your Employer Identification Number (EIN) at the top of the form, ensuring it's correct, as this links your business with your tax obligations.

- Complete the 'Type of Return' section by checking all applicable boxes, indicating whether this is an amended return, for a successor employer, or if there were no payments to employees for the year.

- Fill out your business name and trade name, followed by your complete address, including city, state, and ZIP code.

- In Part 1, report the state unemployment tax details. If you operated in one state, enter its abbreviation. If multi-state, check the appropriate option.

- Proceed to Part 2 and report the total payments to employees and any payments exempt from FUTA tax. Complete additional fields as necessary, including fringe benefits if applicable.

- Calculate your taxable FUTA wages by subtracting the total payments exempt from tax from the total payments made, and record this value.

- In Part 3, determine any adjustments needed for your FUTA tax by following the provided criteria and inputting relevant values.

- Complete Part 4 by calculating your total FUTA tax after adjustments, reporting any balance due or overpayment as necessary. Make sure all calculations are accurate.

- If applicable, fill out Part 5 to report your FUTA tax liability by quarter.

- Indicate whether you would like a third-party designee to discuss this return with the IRS in Part 6.

- Finally, ensure you sign and date the form in Part 7, confirming the accuracy of the information provided.

- Review all entered information carefully. Once confirmed, save any changes, download, or print the form for your records.

Start completing your Form 940 online now to ensure timely reporting and compliance.

FUTA exists to provide a source of funding for state unemployment insurance programs in the U.S. This funding helps support workers who find themselves unemployed, ensuring they have a financial safety net. Employers contribute to this fund through taxes reported on Form 940, making it essential for businesses of all sizes. FUTA plays a crucial role in stabilizing the economy during downturns by assisting unemployed individuals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.