Get Ftb 3532 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb 3532 online

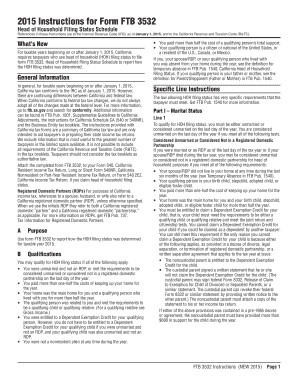

Filling out the Ftb 3532, Head of Household Filing Status Schedule, is an essential step for California taxpayers seeking to report their head of household status. This guide provides a clear and supportive approach to successfully complete the form online.

Follow the steps to accurately fill out the form online.

- Click ‘Get Form’ button to obtain the form and open it in a digital editor.

- Begin with Part I, where you will need to confirm your marital status as either unmarried or considered unmarried on the last day of the year. Ensure you provide accurate information regarding your living situation and whether you lived apart from your spouse or registered domestic partner for the required time period.

- Proceed to Part II, where you will identify your qualifying person. This person must be related to you and meet the criteria set for either a qualifying child or a qualifying relative. Confirm that you have paid more than half of the cost of maintaining your home throughout the year.

- In Part III, input the details of your qualifying person. Enter their full name, social security number, and date of birth. Ensure the name and SSN are consistent with the information on their social security card to avoid any issues with verifying your head of household status.

- Verify the gross income of your qualifying relative as specified in the form. Their income must be less than the federal exemption amount and only taxable income should be considered.

- Lastly, calculate and confirm the days your home was the qualifying person's main residence. Remember that more than half of the year is defined as 183 days. Accurately track days they were living with you, including periods of temporary absence.

- Once all sections are completed, review your entries to ensure accuracy and completeness. You can then save changes, download, print, or share the completed form as needed.

Complete your Ftb 3532 form online today to ensure your head of household status is accurately reported.

Filing as Head of Household can provide significant tax benefits, including a higher standard deduction and more favorable tax rates. To qualify, you must meet certain criteria, like having a qualifying dependent and maintaining a home. If you're confused about whether to file this way, leveraging the resources available on uslegalforms can provide clarity on your eligibility and help with your FTB 3532 form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.